What Is Payroll Tax Account Number

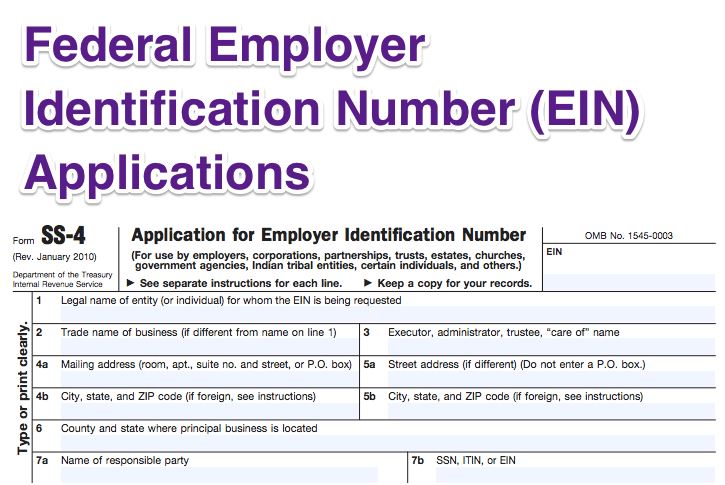

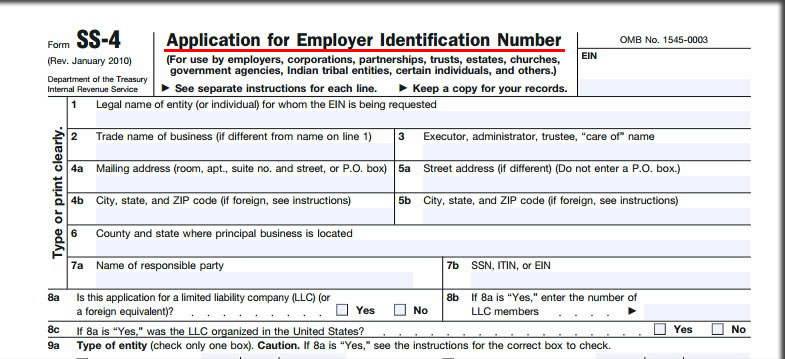

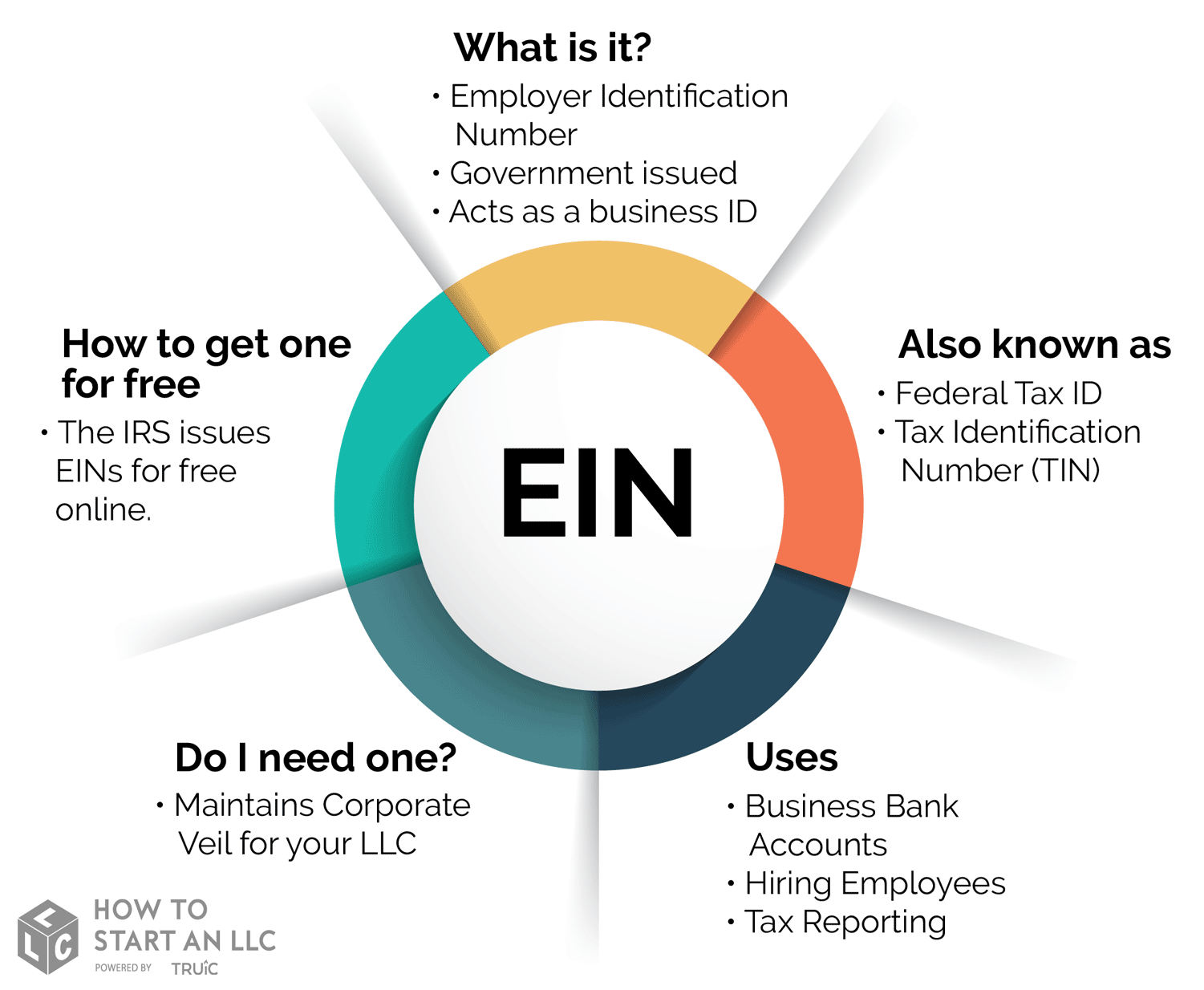

Since the business files and pays taxes through the owner s personal tax return the ssn is the only taxpayer id number needed.

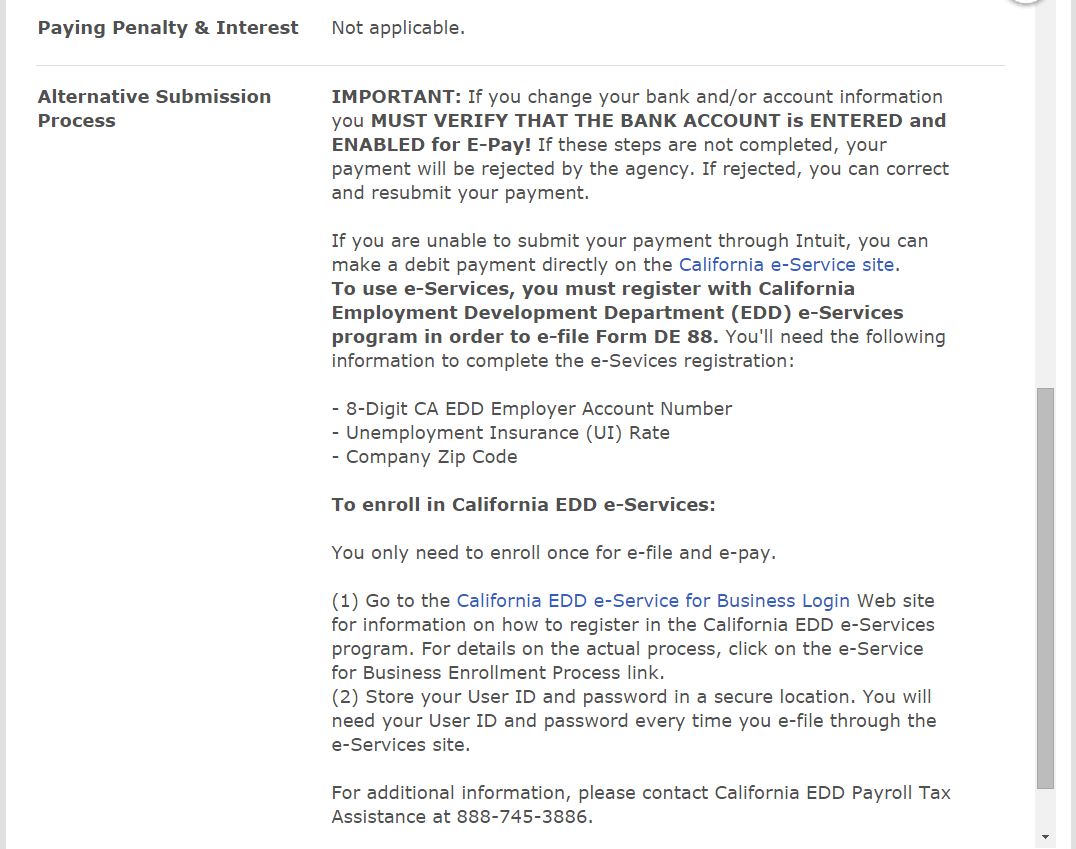

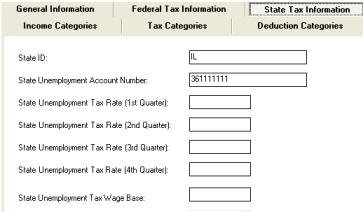

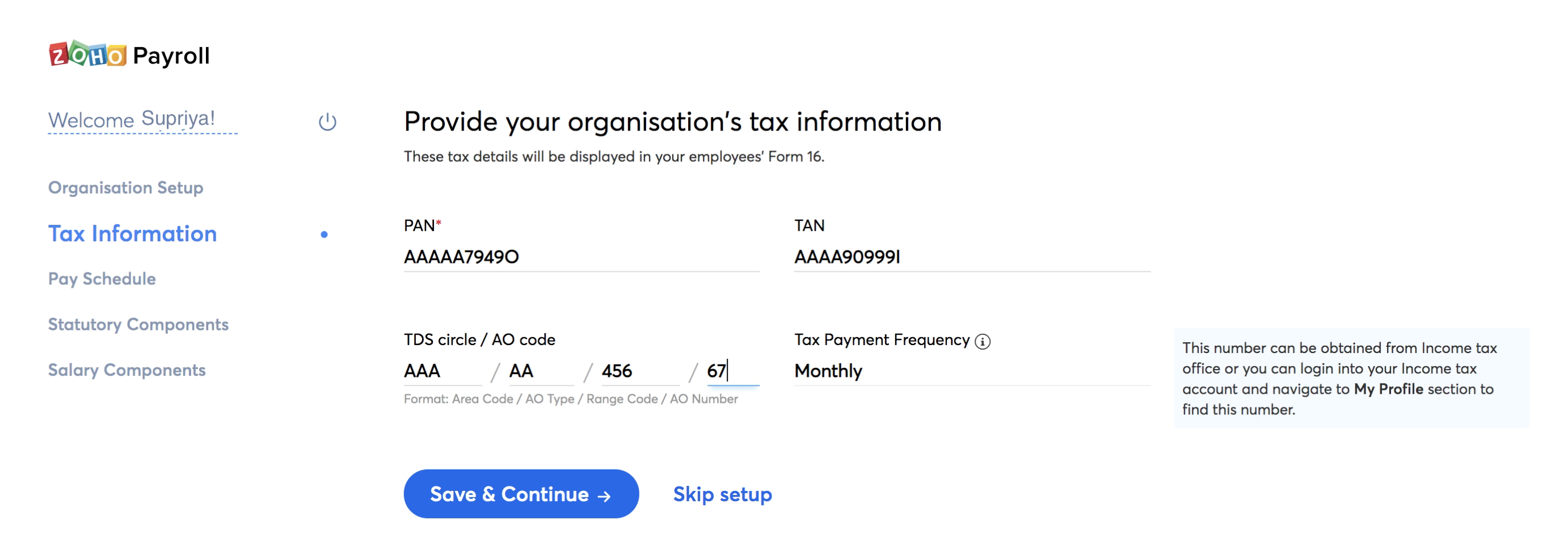

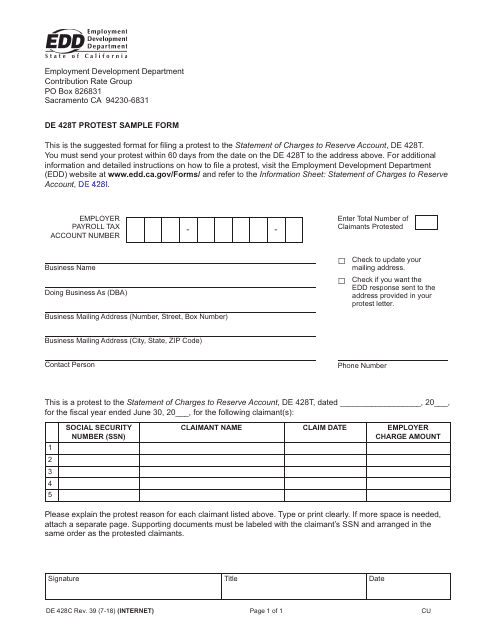

What is payroll tax account number. You must have the following information to open a payroll program account. Employer payroll tax account with the correct legal name. The new employer rate in california is 3 4.

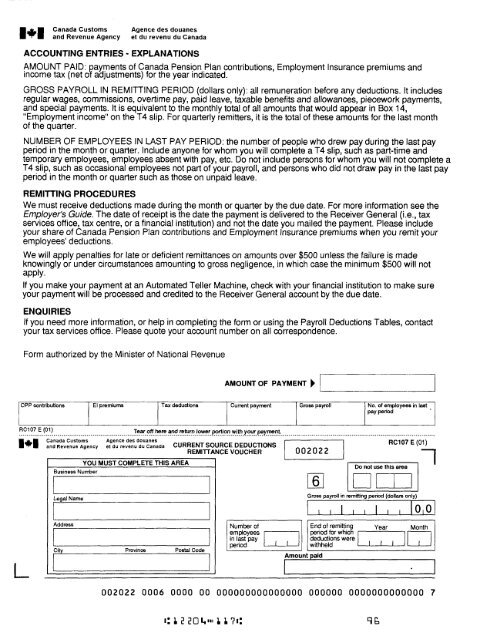

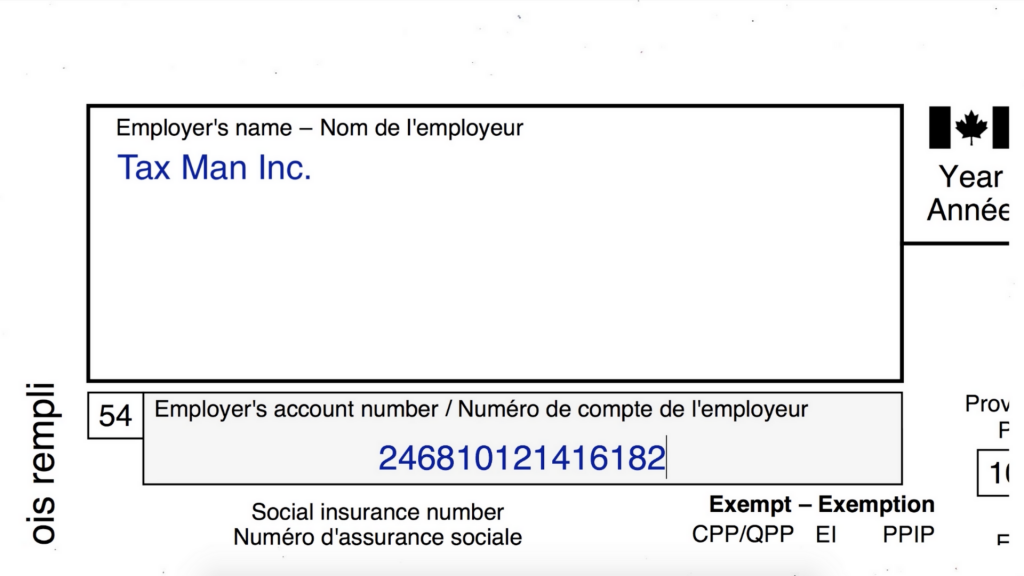

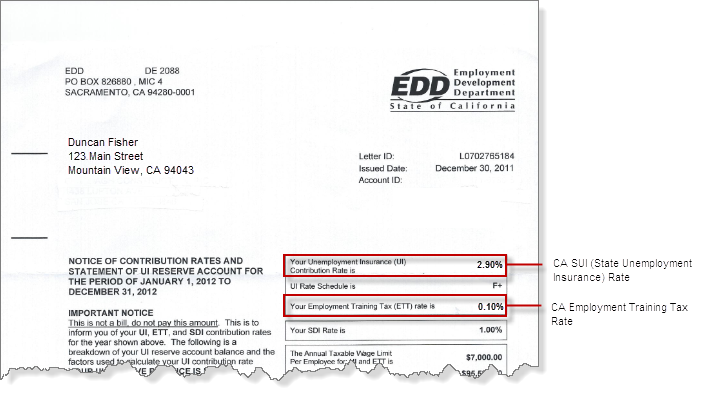

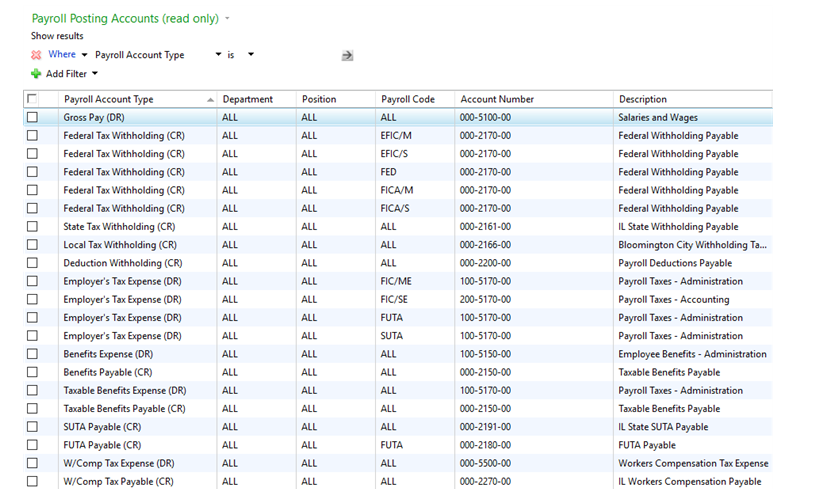

In most cases when you register online you will be issued a payroll tax account number within a few minutes. This 15 character payroll program account number contains the nine digit business number bn the bn is a unique federal government numbering system that identifies your business and the. The ett rate in most cases is 0 1.

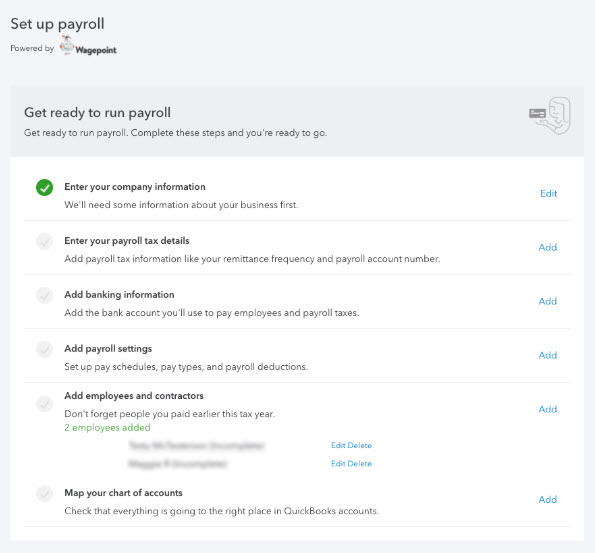

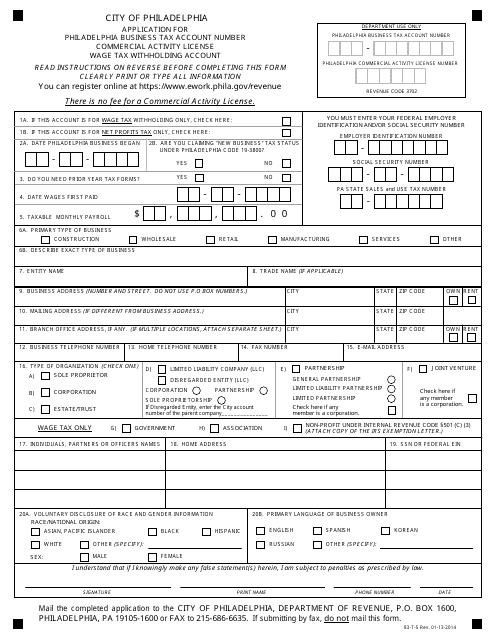

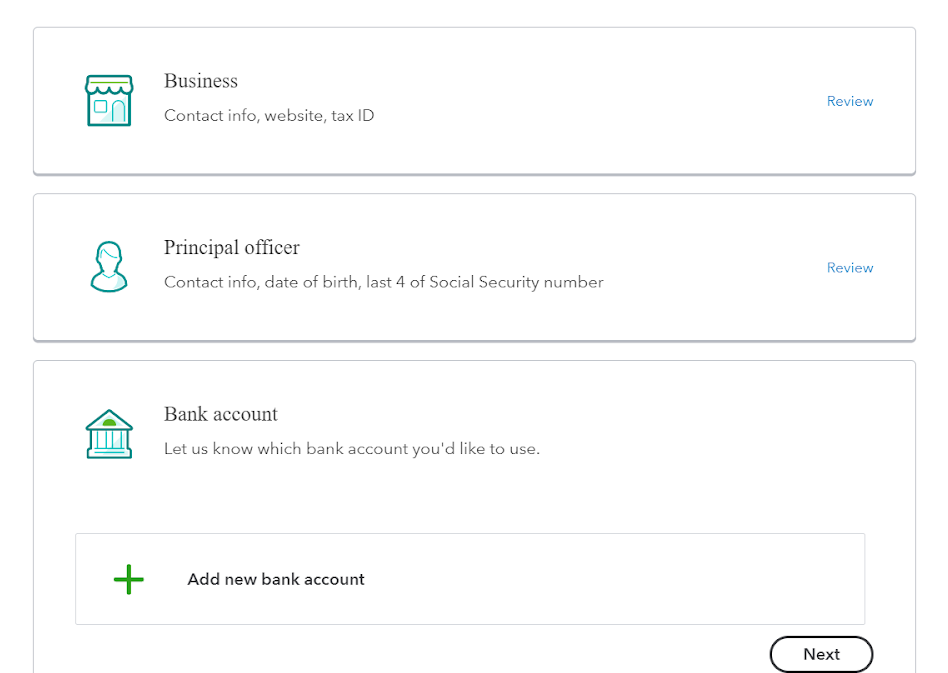

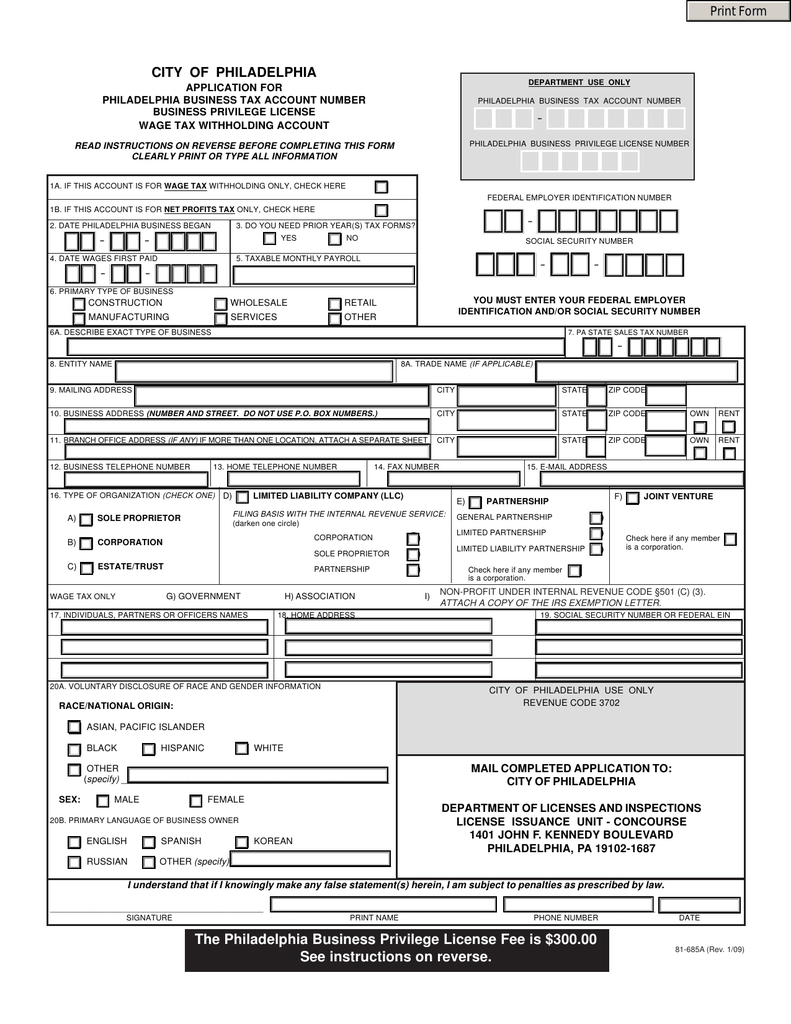

When the information is completed select next to continue. What is a state ein or account number. Date employees received their first wages or leave blank if date is unknown months covered for payroll of employees wages.

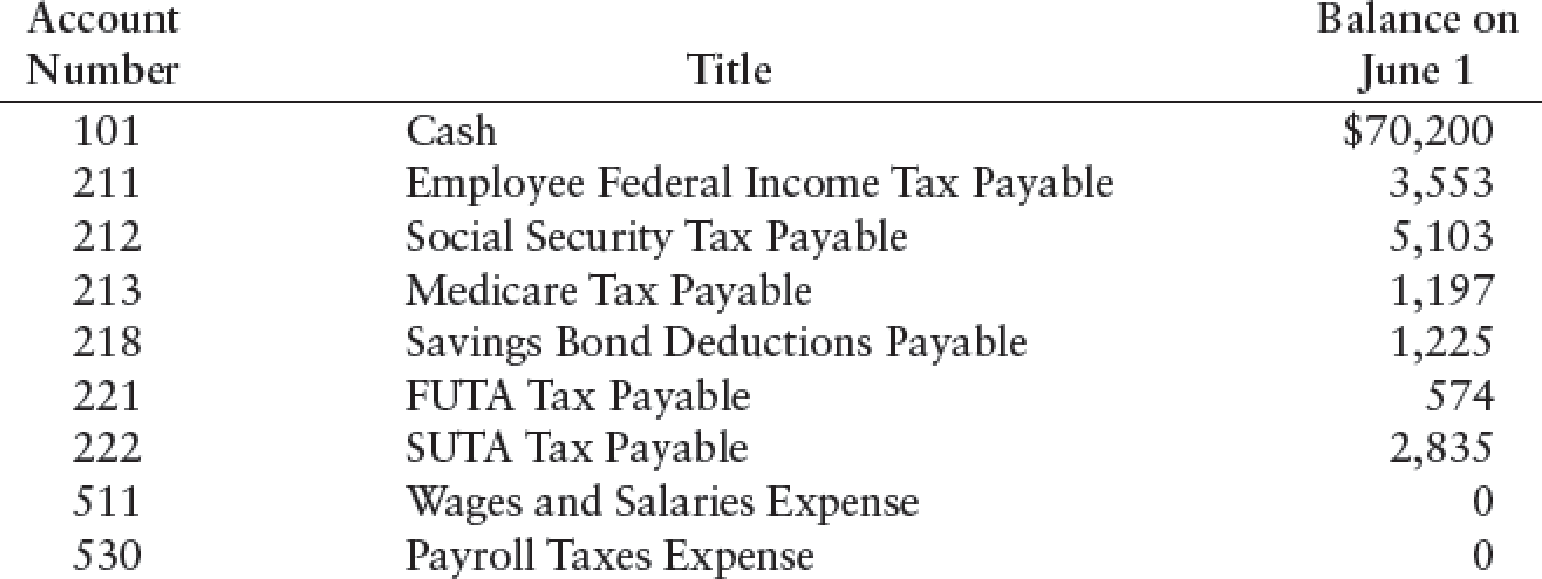

Payroll tax liabilities and remittances. If you have a federal tax id number enter it here. A payroll program account is an account number assigned to either an employer a trustee or a payer of other amounts related to employment to identify themselves when dealing with the canada revenue agency.

Payroll service name if any country of the parent company or affiliate. If your business is registered with the california secretary of state sos enter the id number here. Some states assign separate employer numbers for the different.

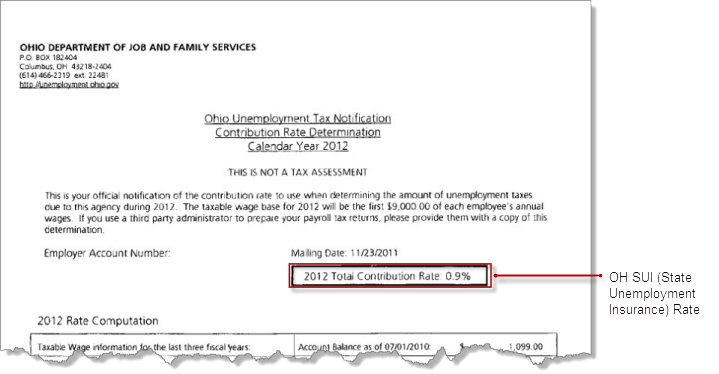

Type of pay period for example weekly quarterly number of employees. California employment training tax rate. A state employer identification number ein or employer account number ean is a number assigned by a state government to an employer to track one of the following.

In most municipalities the income tax comes to approximately 32 percent with the two higher income brackets also paying a state tax of 20 or 25 percent respectively. Do not omit any words or use any abbreviations.

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)

1.jpg)

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)

/application-form-w-9--request-for-taxpayer-identification-number-tin-and-certification-close-up-shot-867665546-af6d55c962a24fe38165f2a1aa45f726.jpg)