What Is Payroll Tax

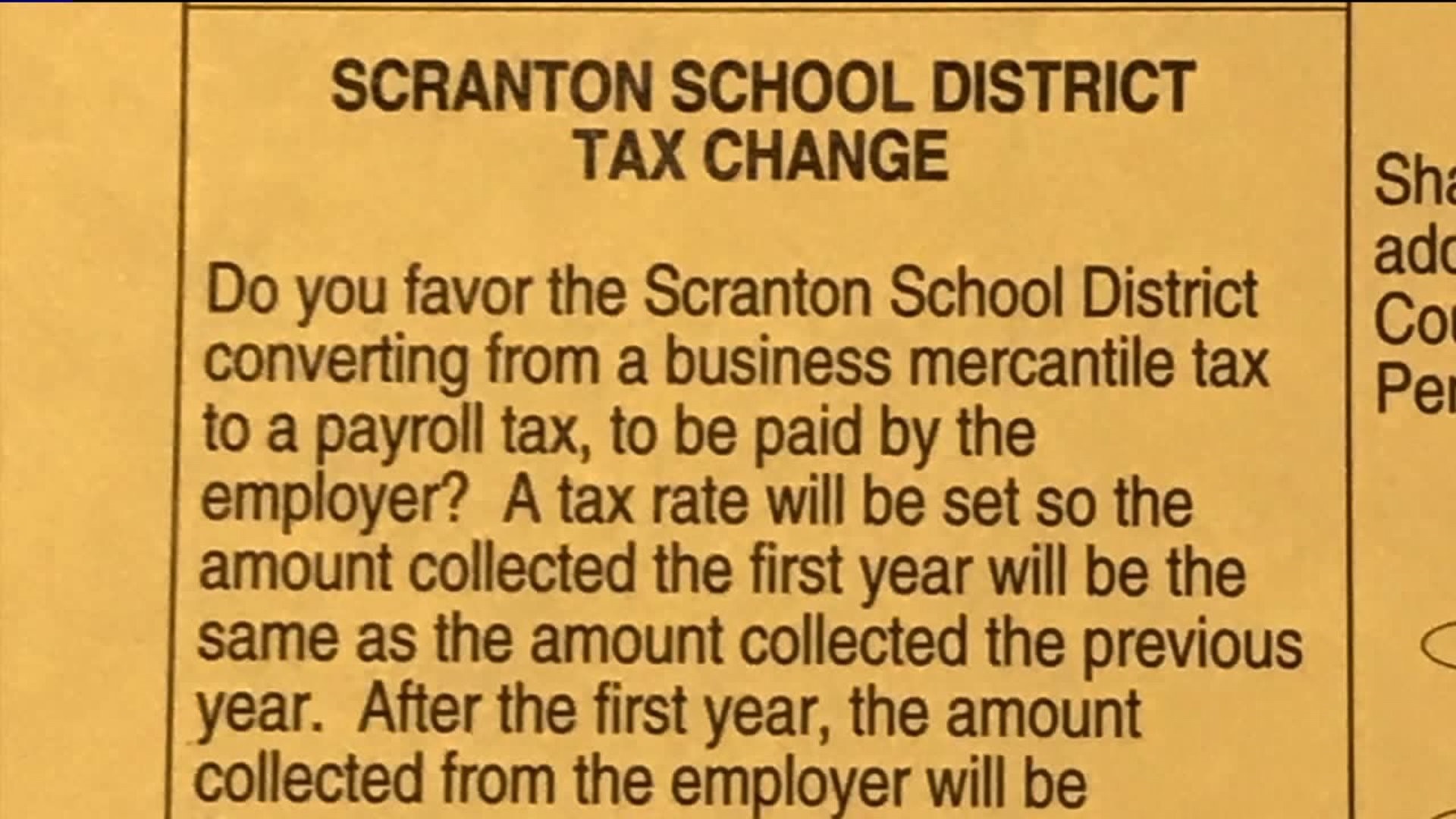

A payroll tax is a tax withheld from an employee s salary by an employer who remits it to the government on their behalf.

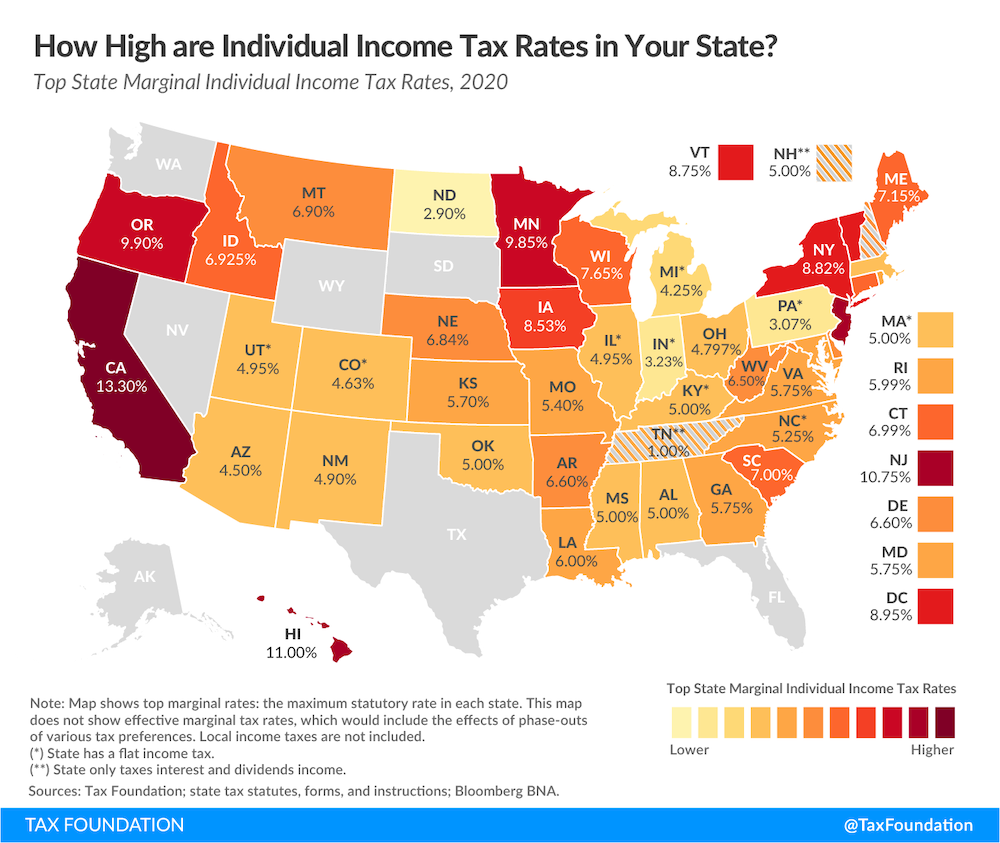

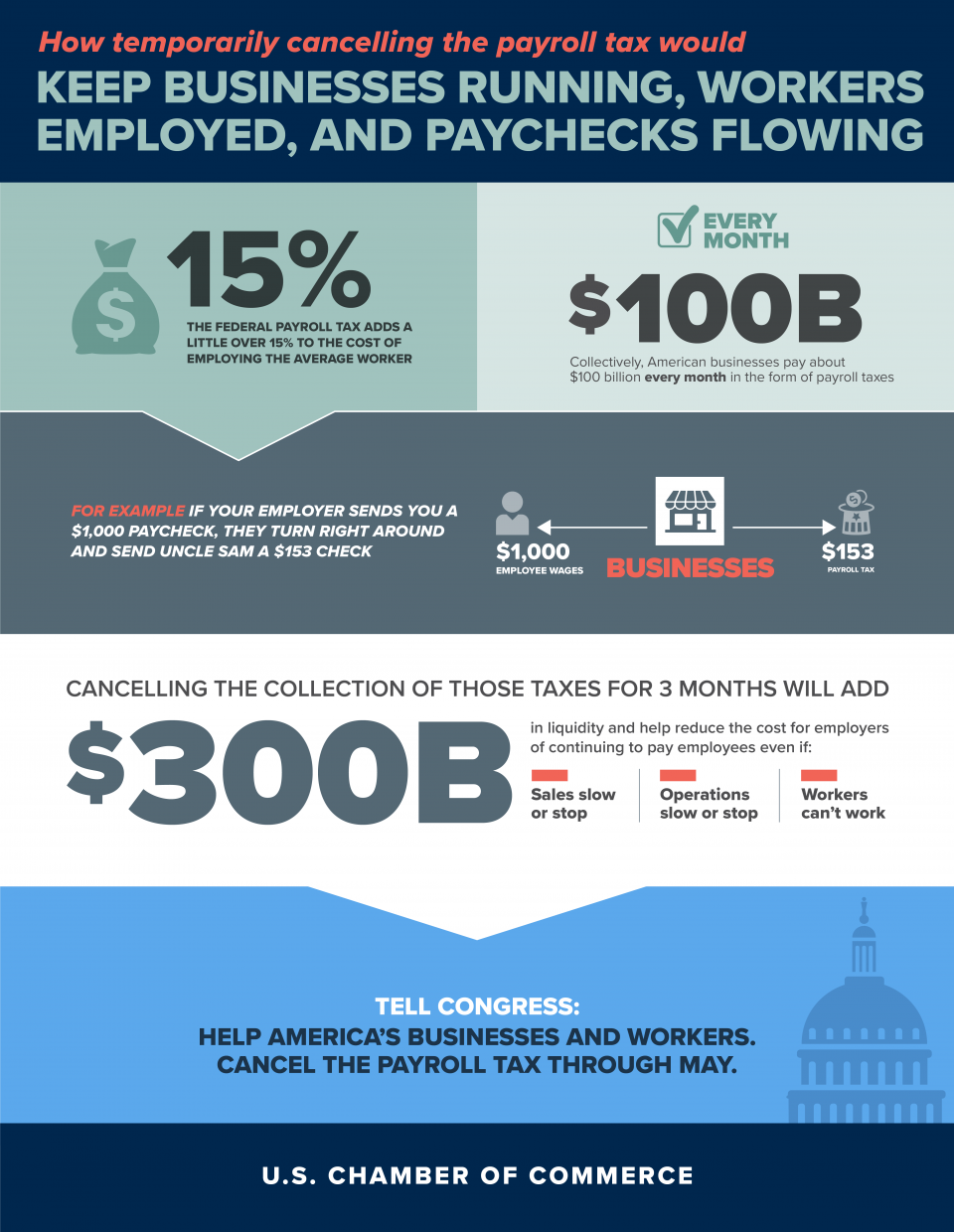

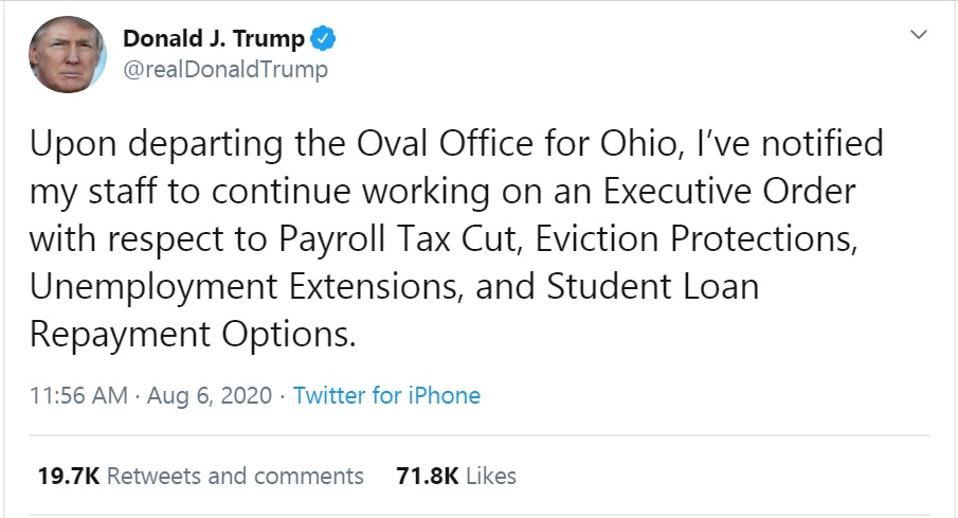

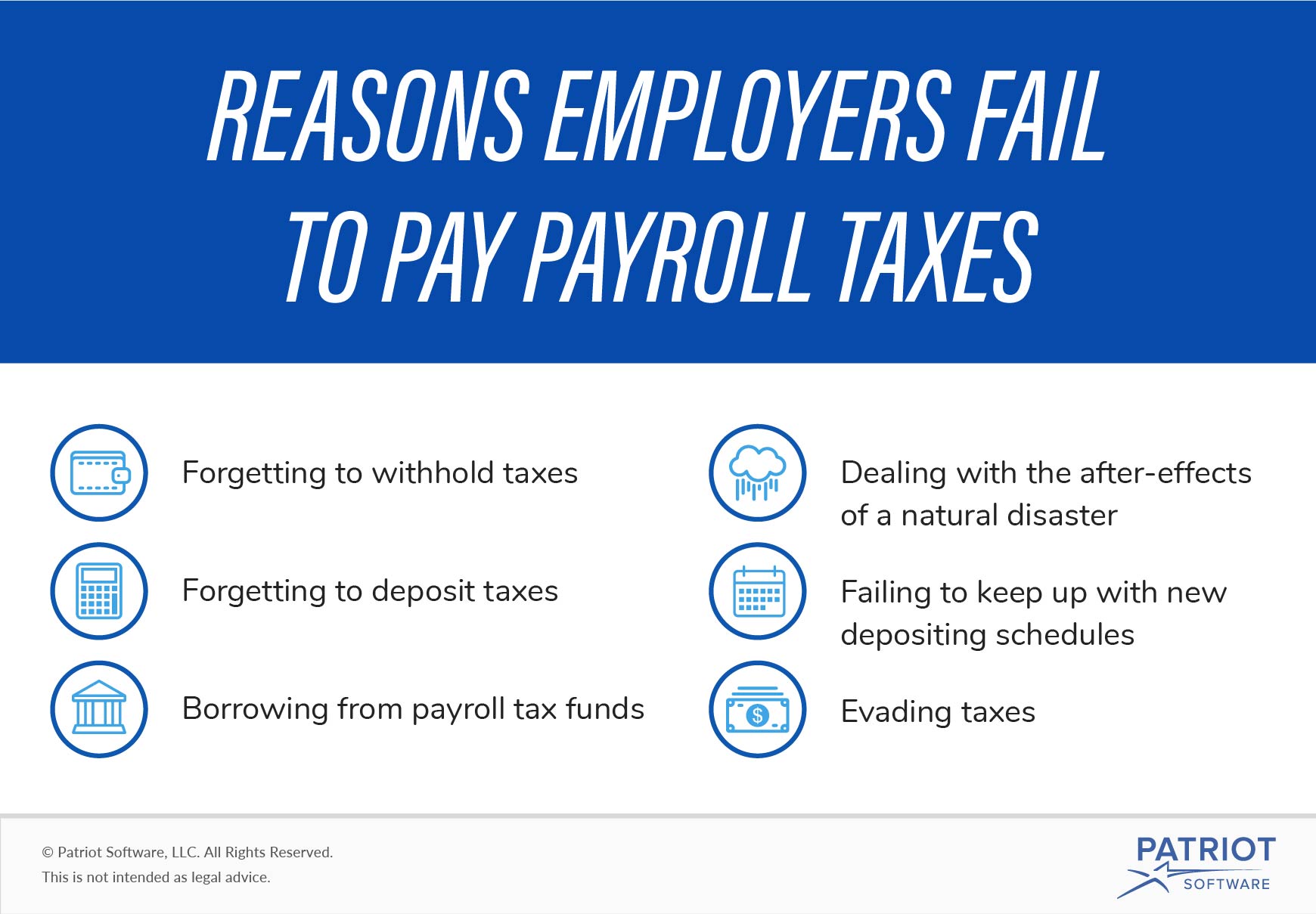

What is payroll tax. It masks the costs of the programs that payroll taxes pay for. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. Payroll taxes are taxes employers withhold from employees pay and remits on behalf of employees and themselves to the appropriate taxing agencies.

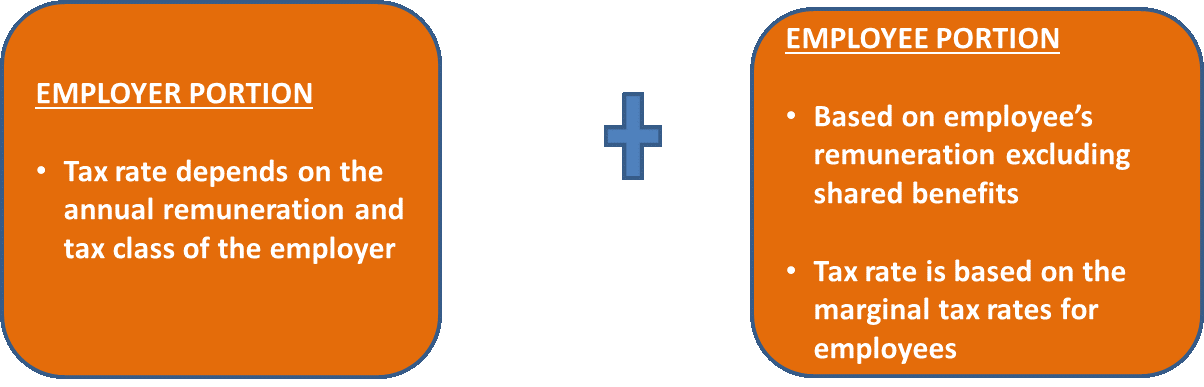

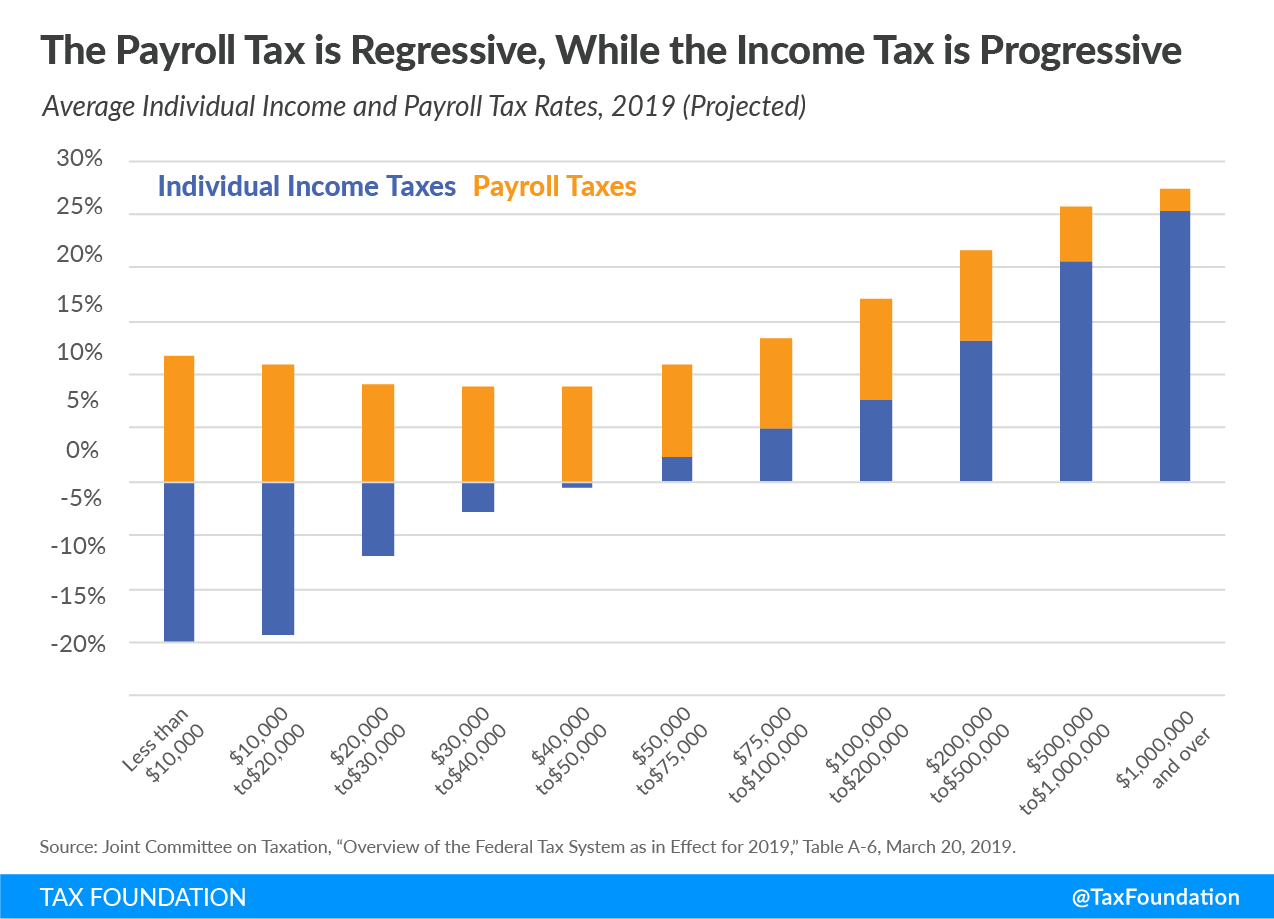

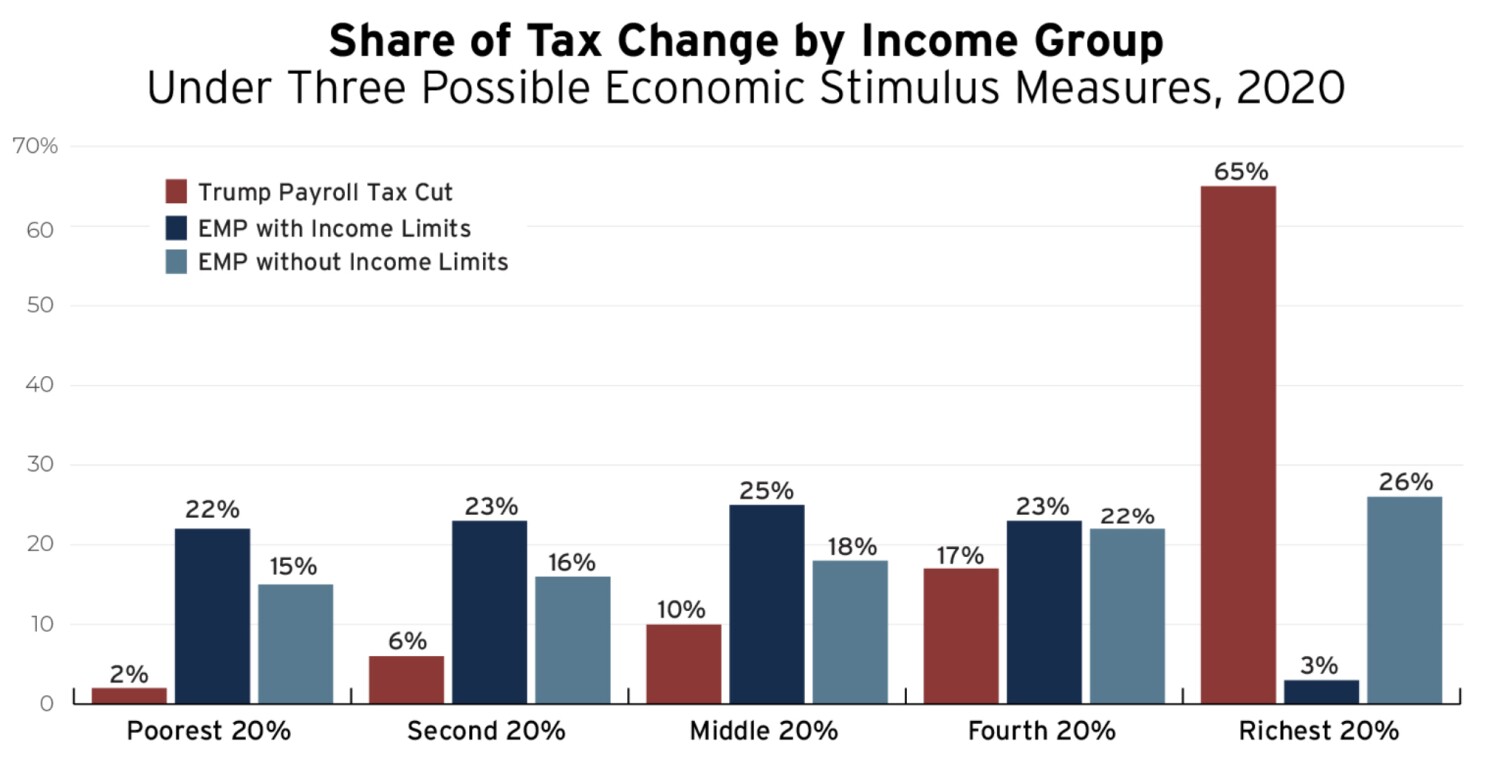

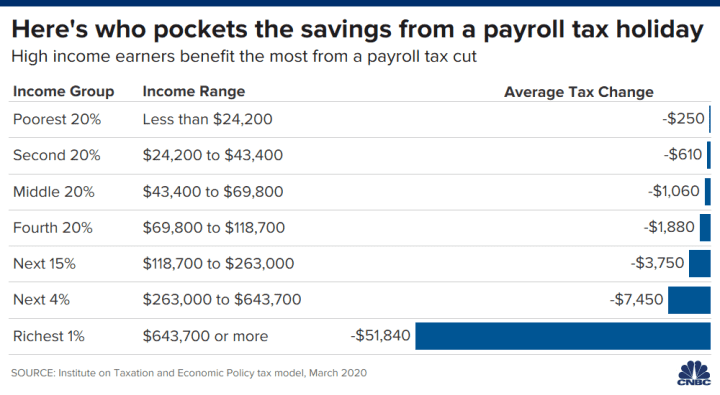

Because payroll taxes are paid only on income up to the wage base limit a payroll tax cut also disproportionally benefits low and middle income workers who are taxed on their entire salaries. Deductions from an employee s wages and taxes paid by the employer based on the employee s wages. As an employer you are expected to collect and pay these taxes through your payroll process.

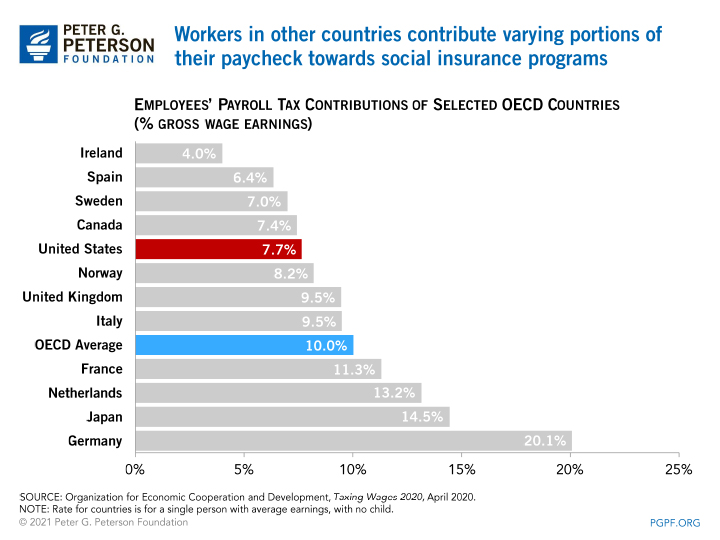

Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their staff. Besides the fact that the federal government s imposition of employer side payroll taxes is misleading it also leads to a possible problem.

:strip_icc()/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)

/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)

/payroll-tax-concept--papers--calculator-and-money--1128492914-ea403a57dd164b3f830ab222c2d24ee7.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-182760257-56a4f3b73df78cf772857675.jpg)