What Is Payroll Tax Expense

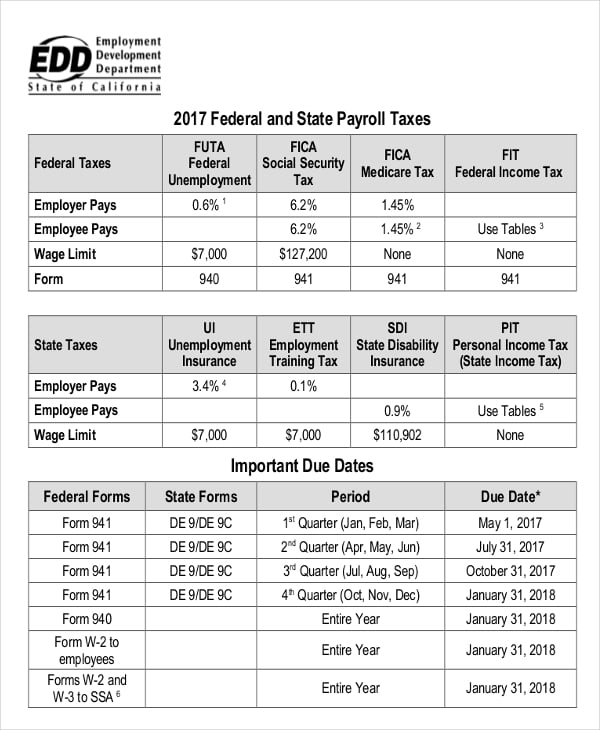

A payroll tax is a tax withheld from an employee s salary by an employer who remits it to the government on their behalf.

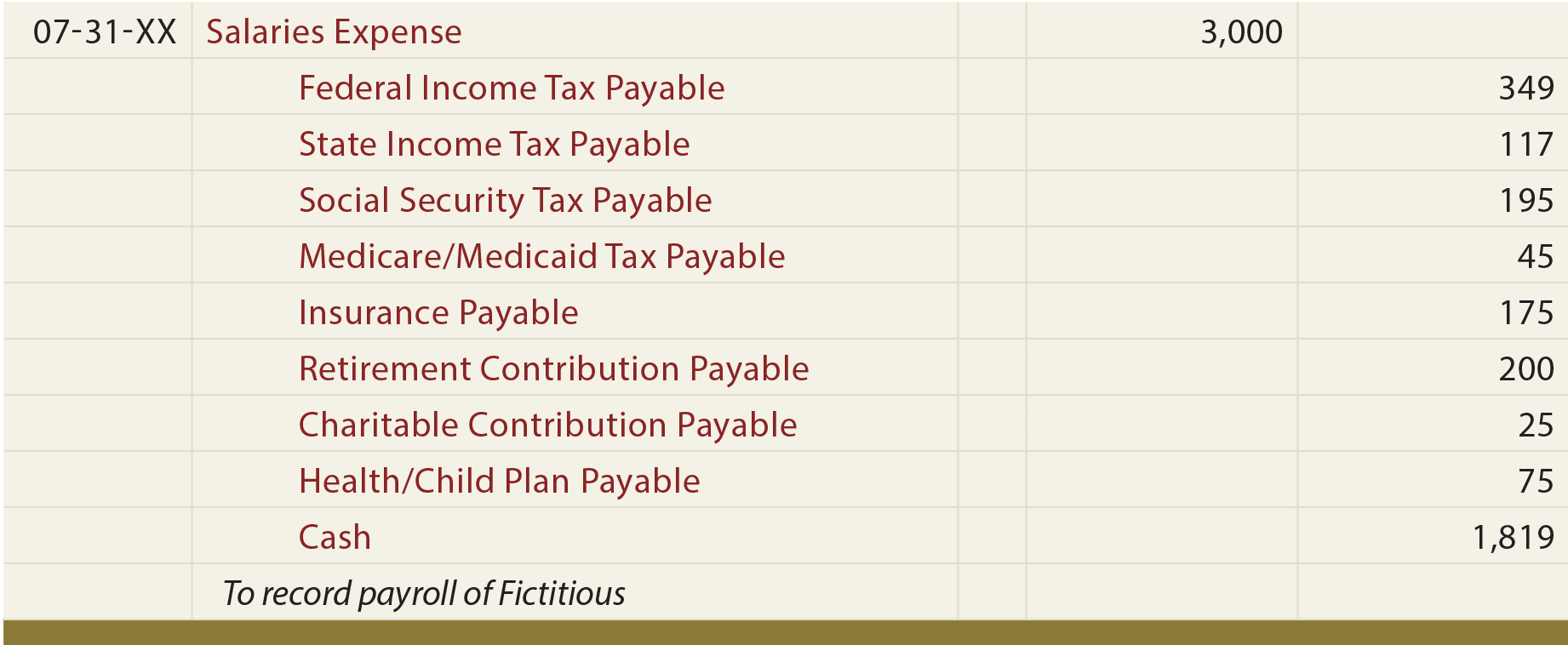

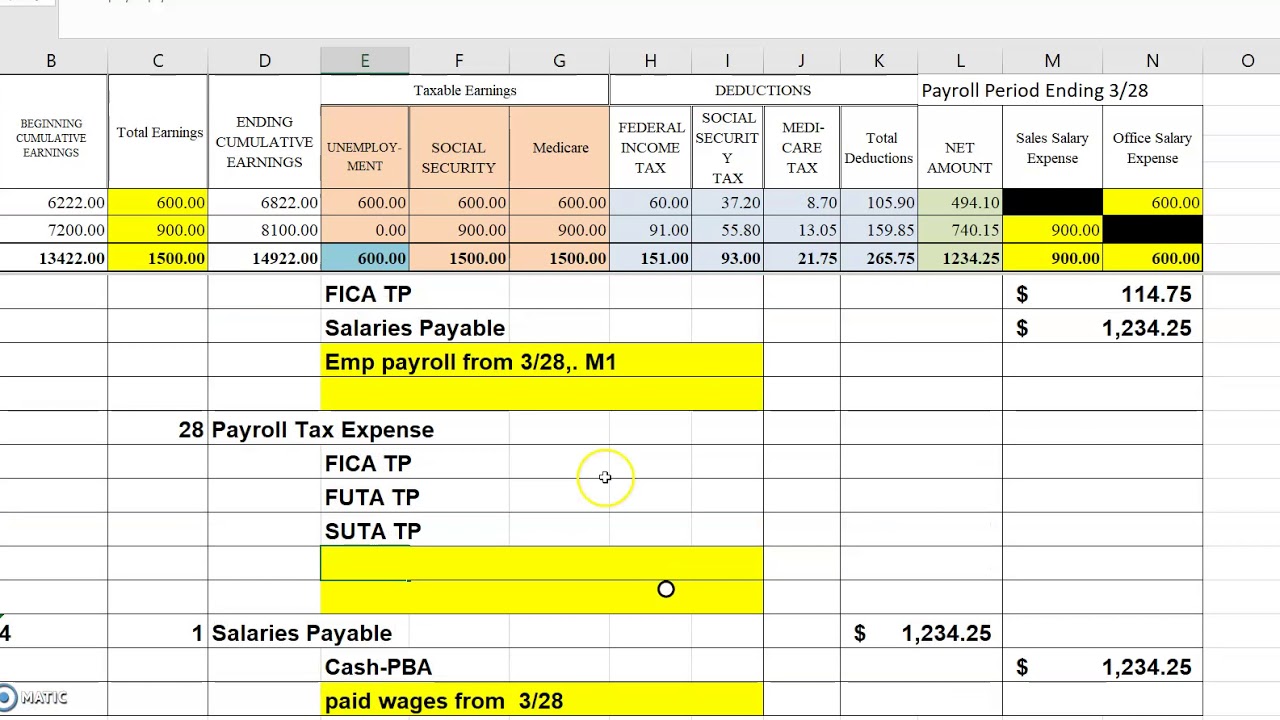

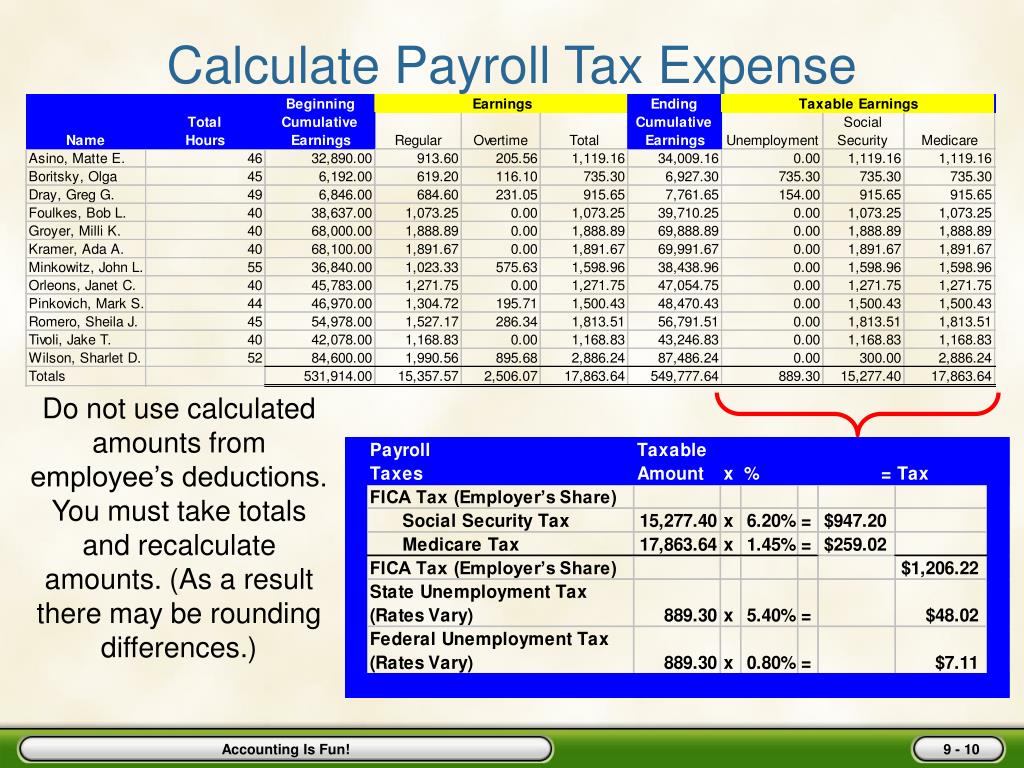

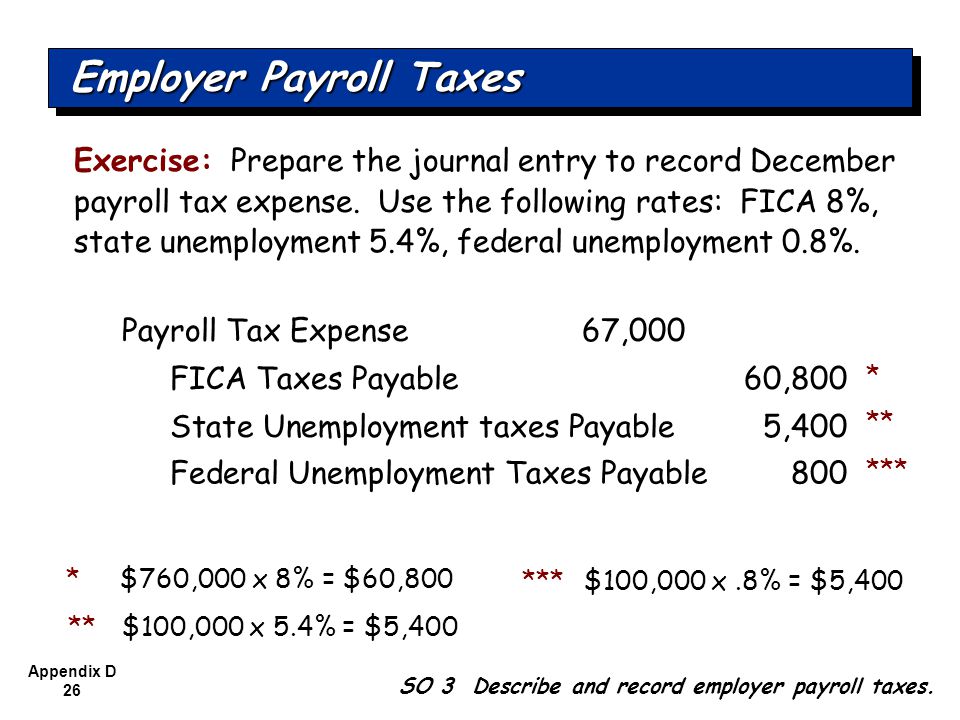

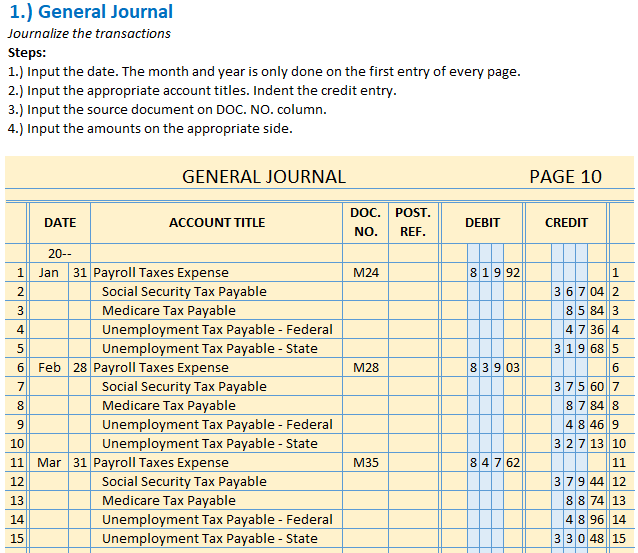

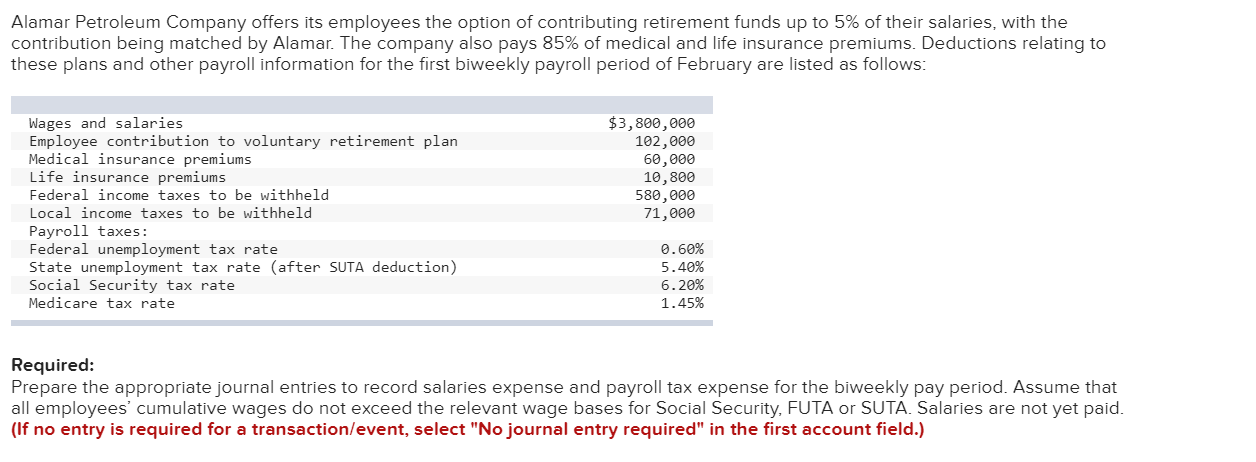

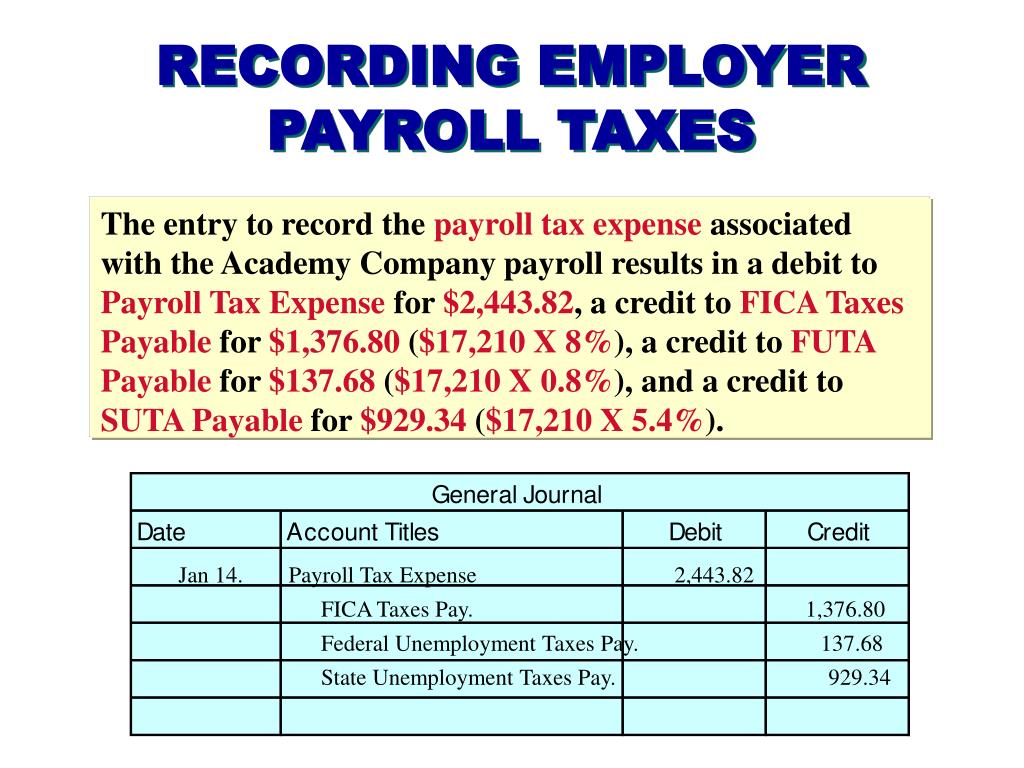

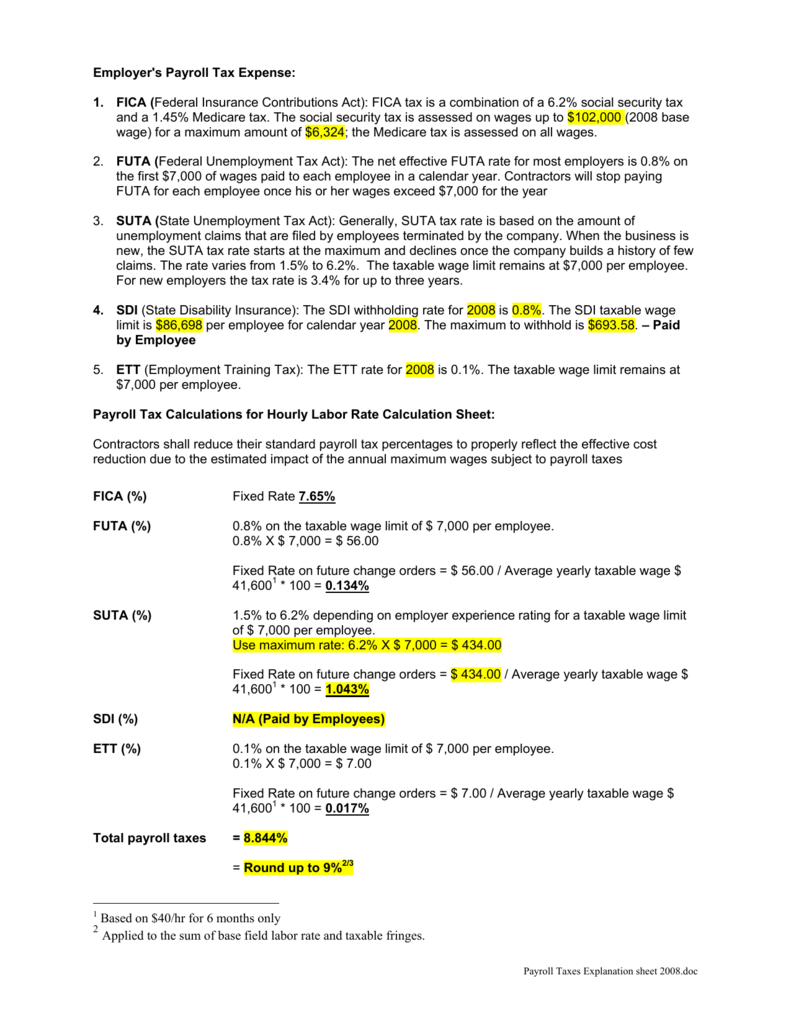

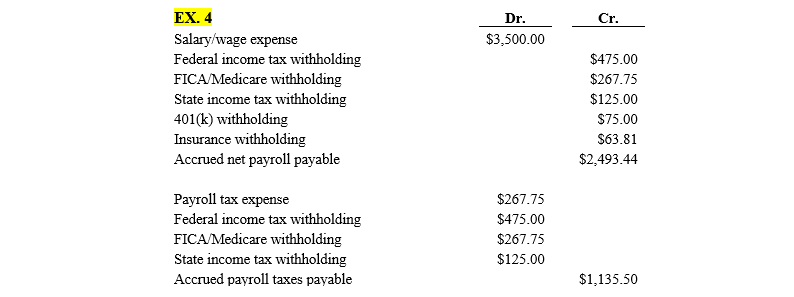

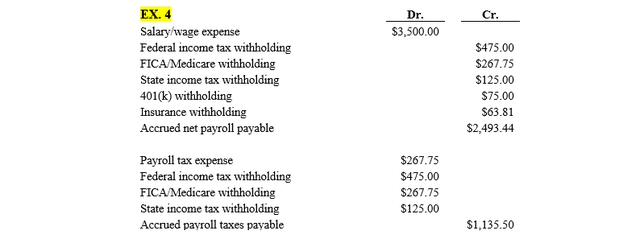

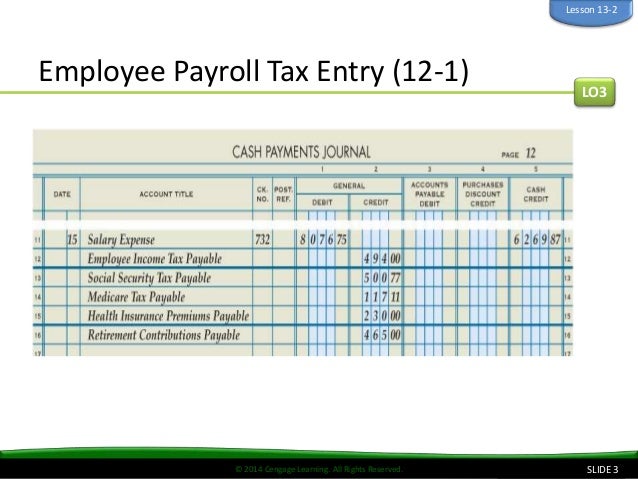

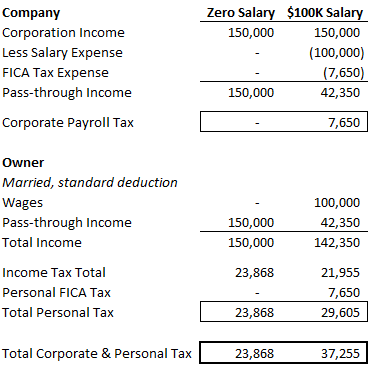

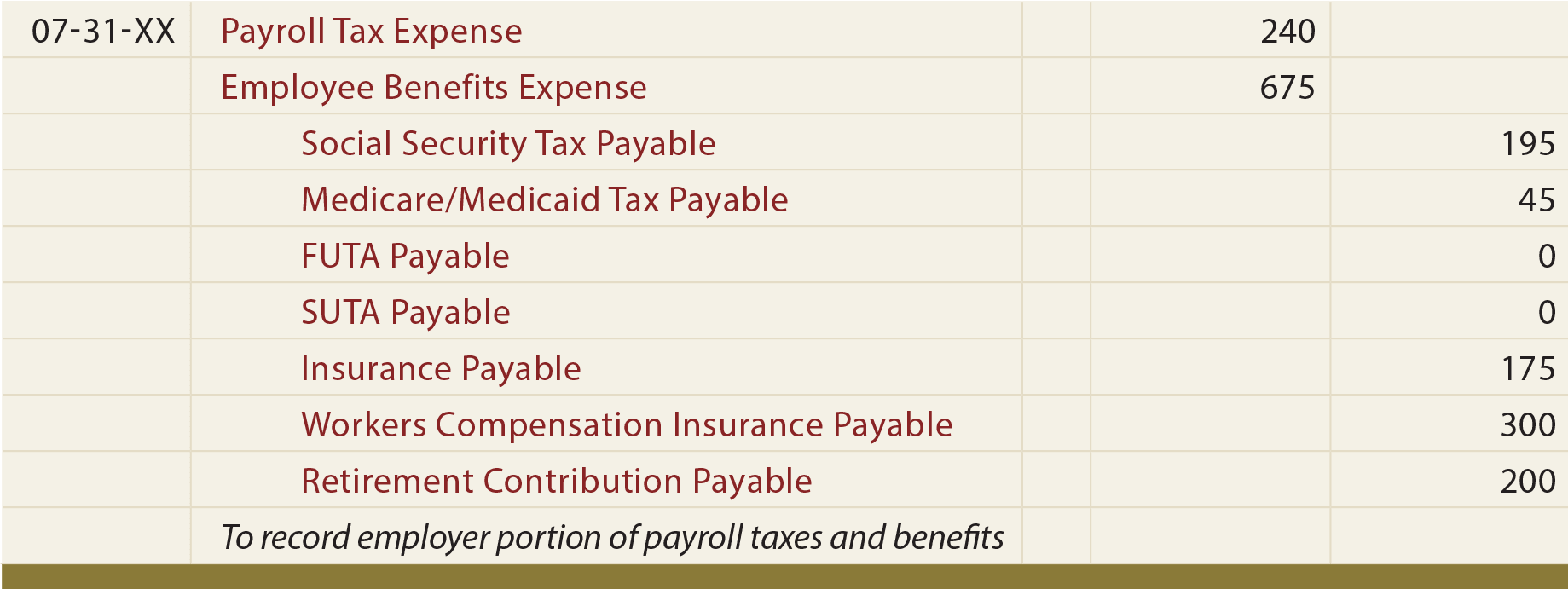

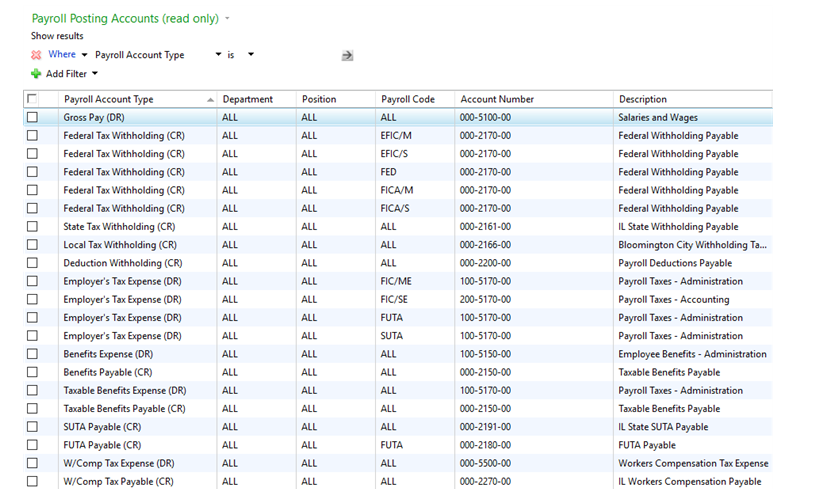

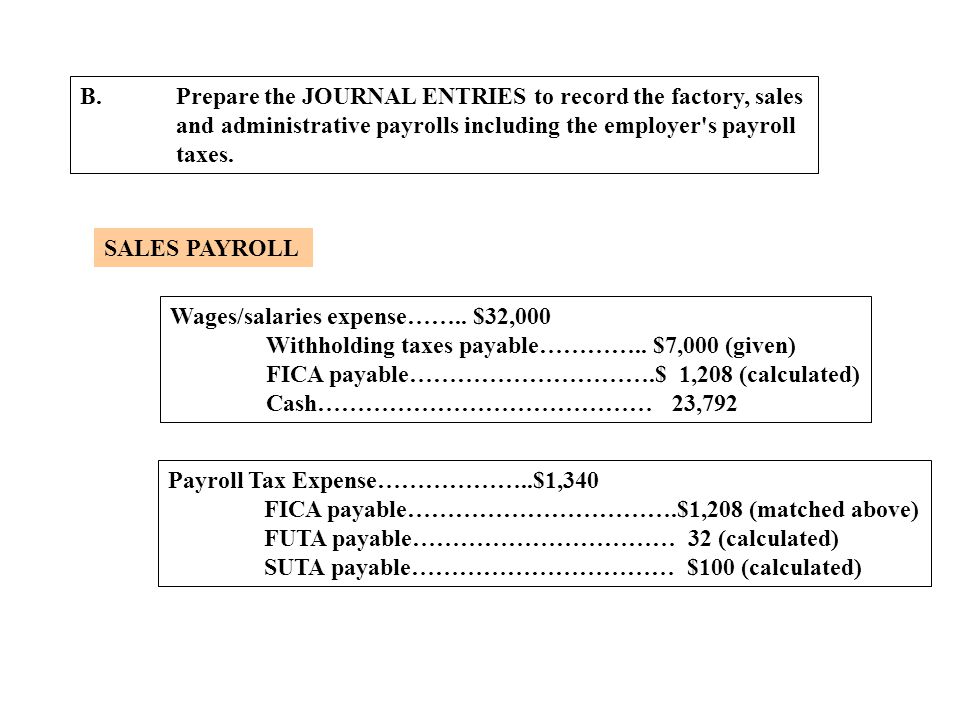

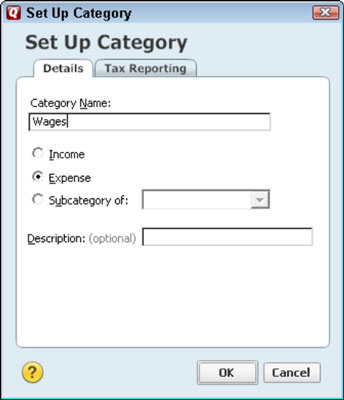

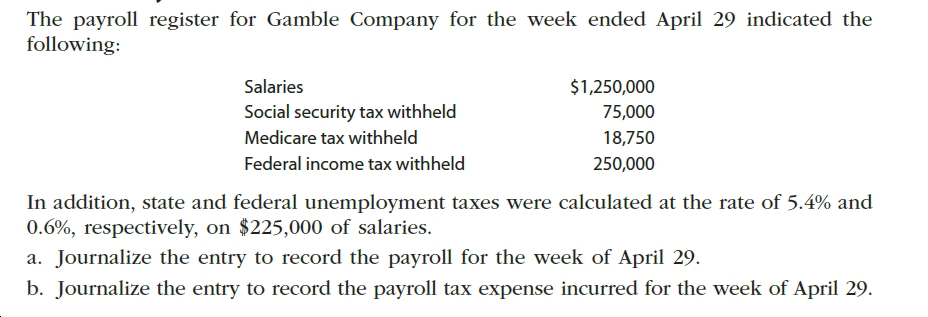

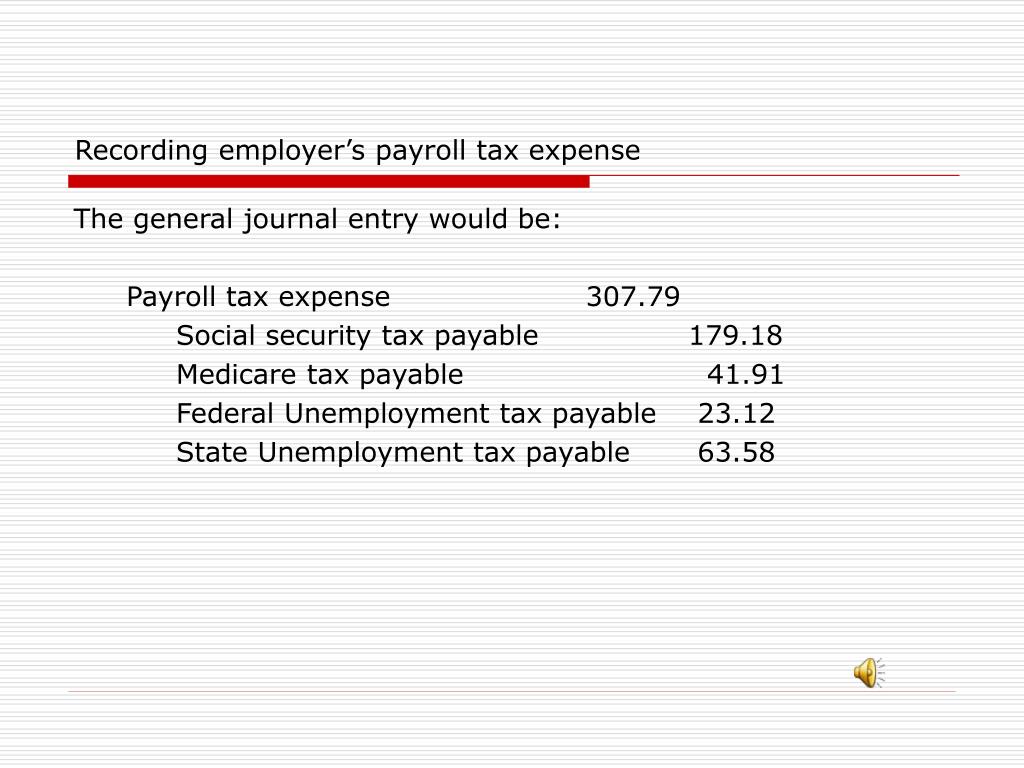

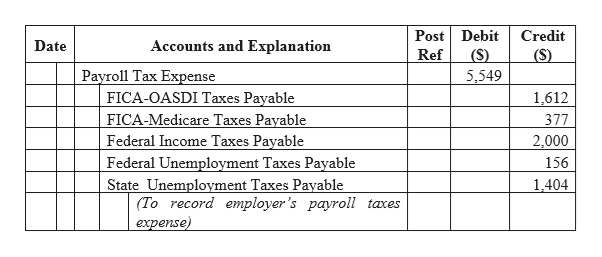

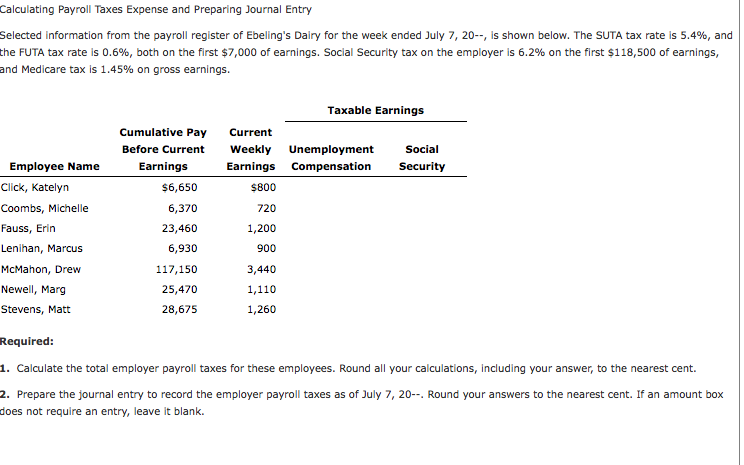

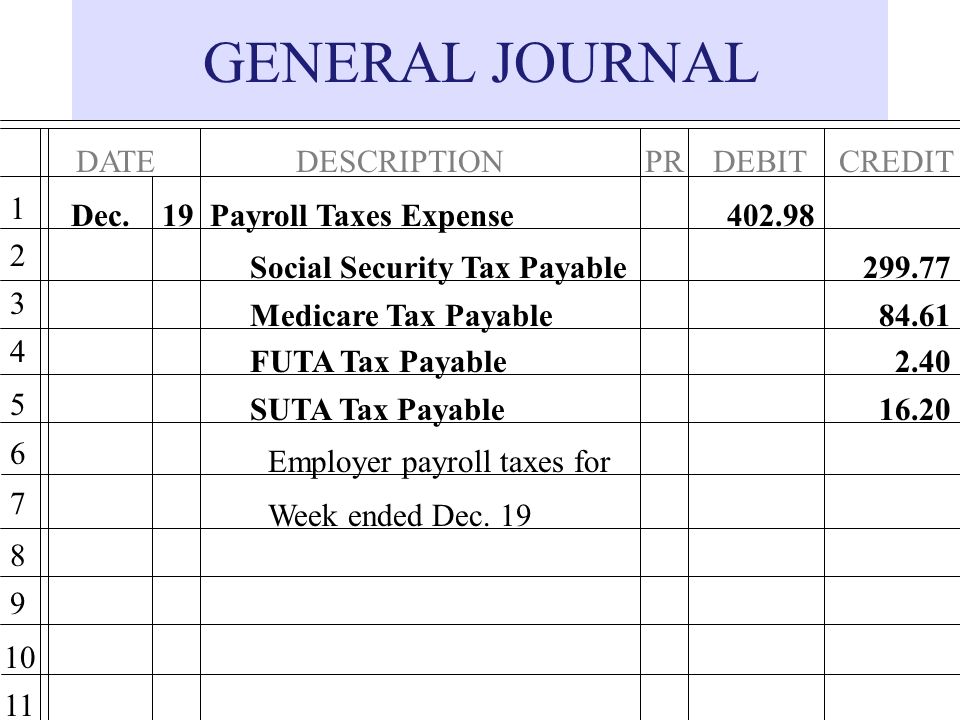

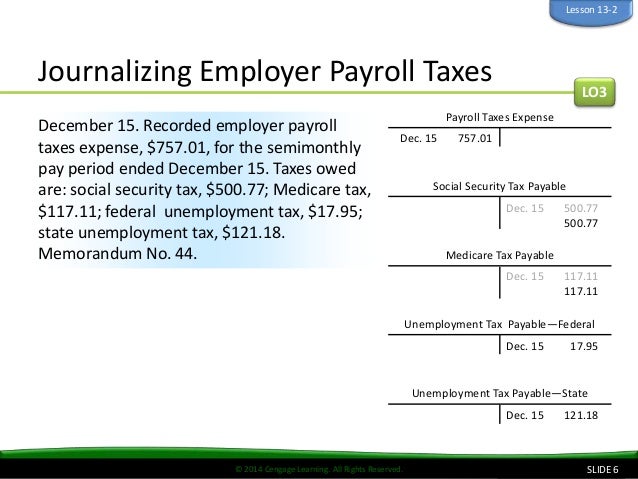

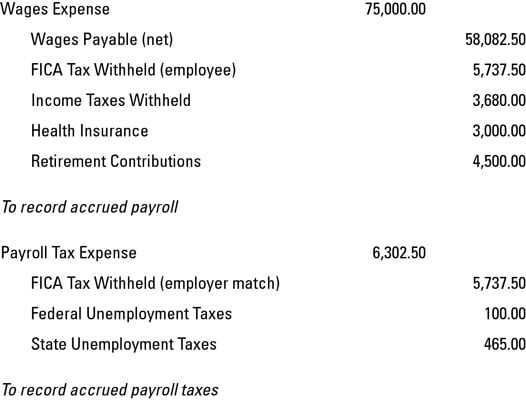

What is payroll tax expense. These taxes are an added expense over and above the expense of an employee s gross pay. Employer payroll taxes. In many industries payroll expense is the biggest expense category so it is critical for businesses to manage payroll expenditures shrewdly.

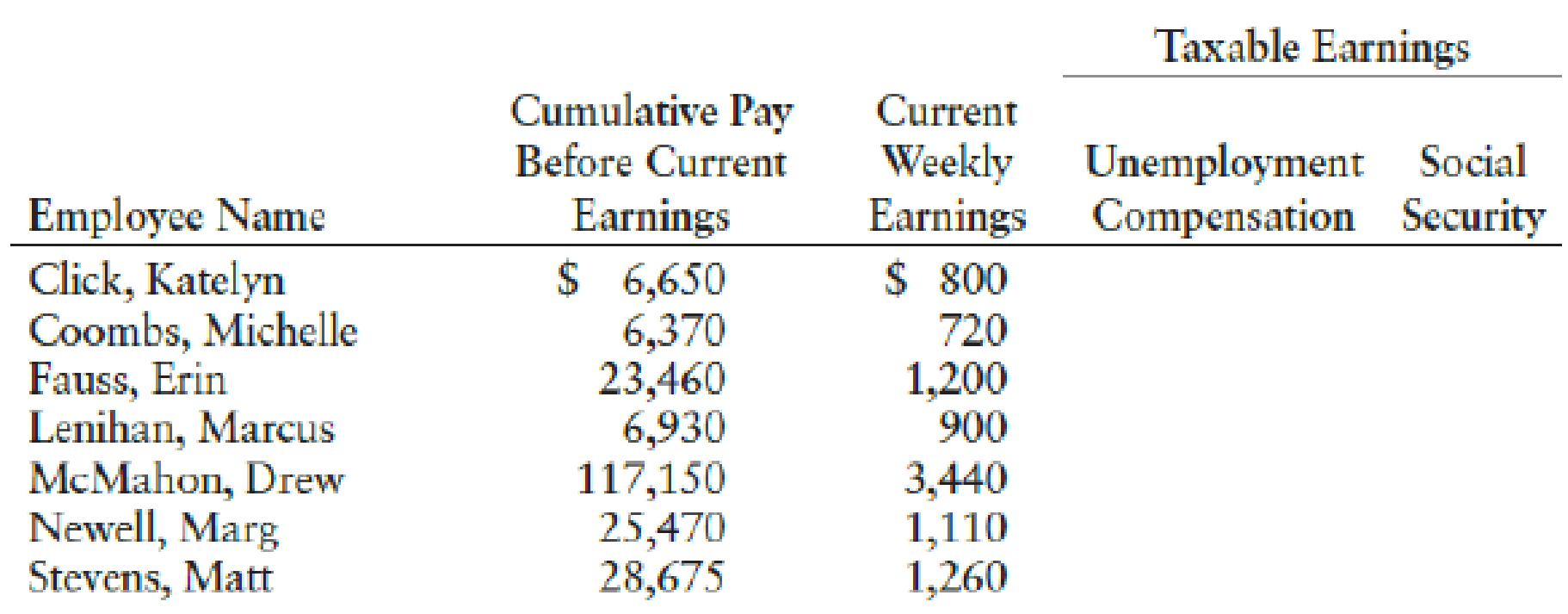

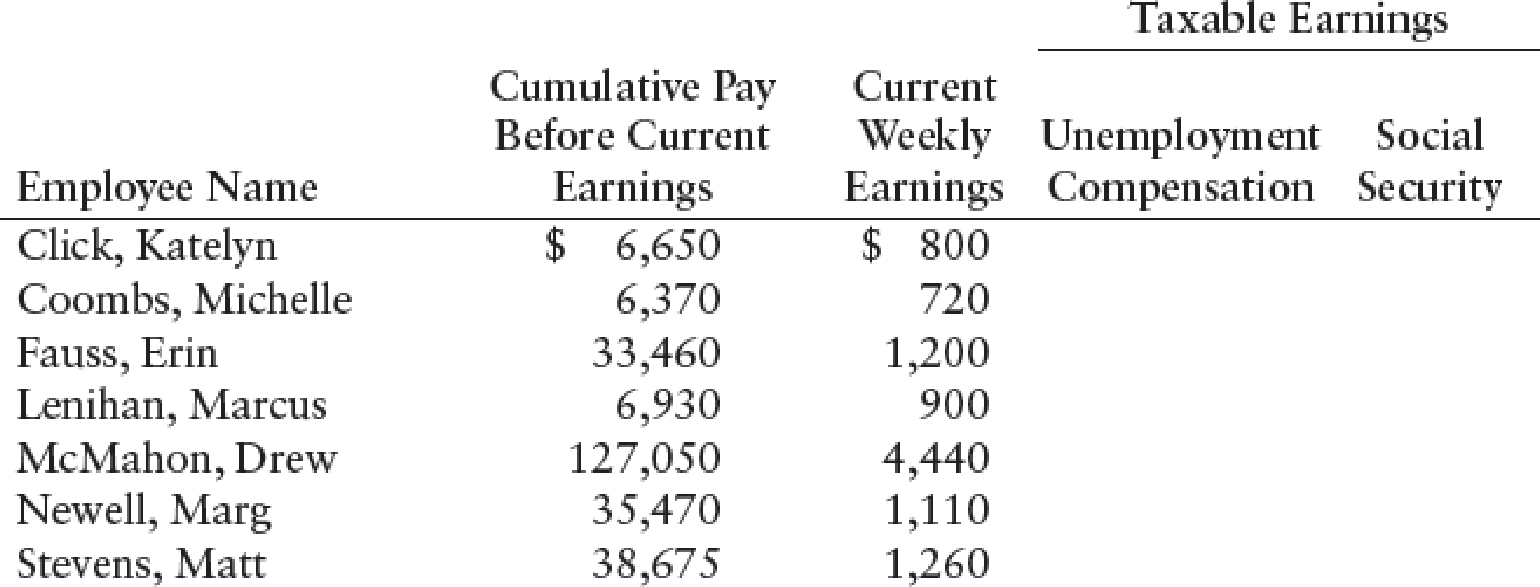

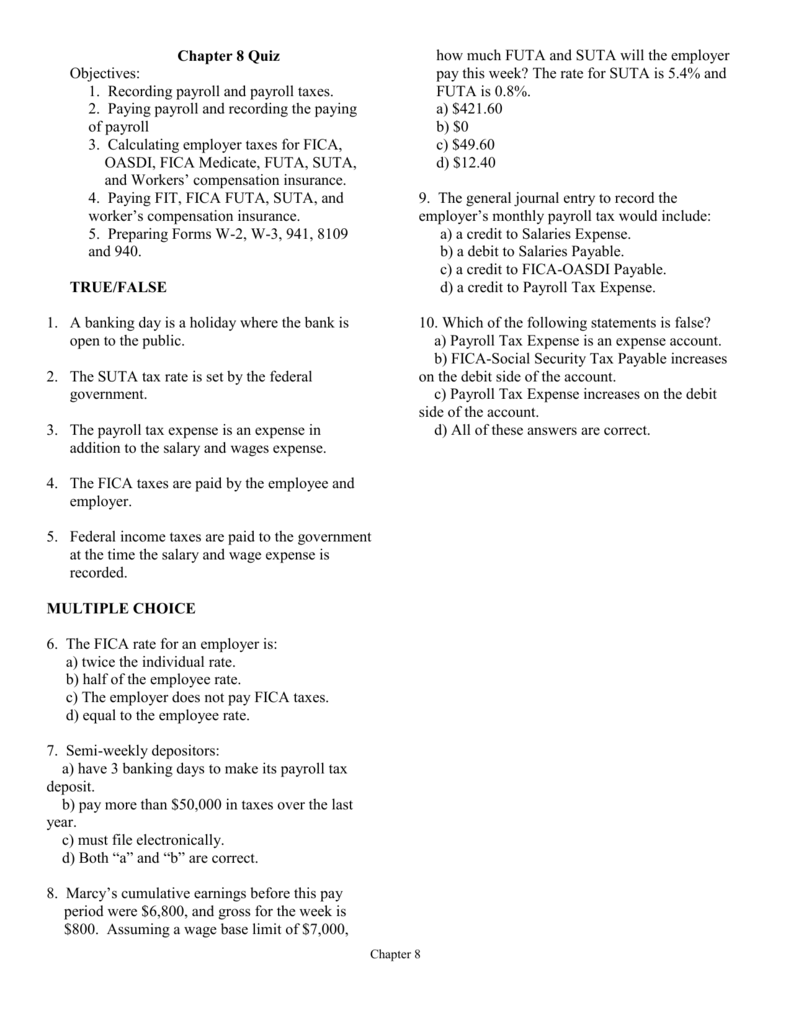

The tax is based on wages salaries and tips paid to employees. Are payroll withholding taxes an expense or a liability. Companies are responsible for paying their portion of payroll taxes.

Definition of payroll withholding taxes. Payroll withholding taxes are amounts withheld from employees wages and salaries. The employer portion of payroll taxes includes the following.

The amounts withheld are actually the employees money that the employer is required by law to withhold and remit to the government. Payroll expense is synonymous with the terms salary expense and wage expense.

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)