What Is Payroll Tax Relief

A payroll tax is a tax withheld from an employee s salary by an employer who remits it to the government on their behalf.

What is payroll tax relief. Identify whether and to what extent an employee may not be providing services. Here s what that means for workers published wed mar 25 2020 1 39 pm edt updated fri mar 27 2020 1 51 pm edt. Payroll tax relief is meant to help businesses that owe payroll taxes or those that should have been withheld from employees paychecks.

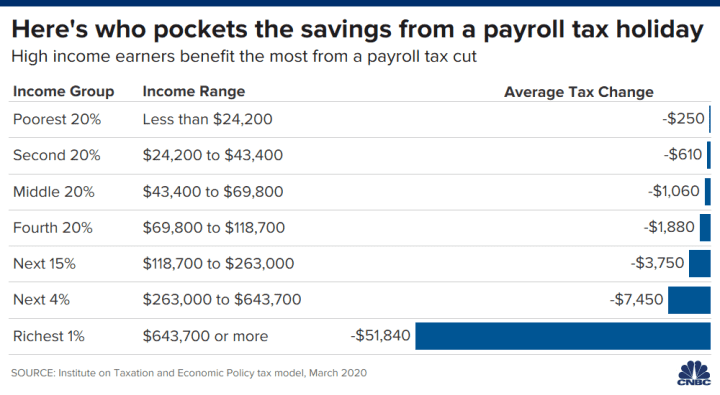

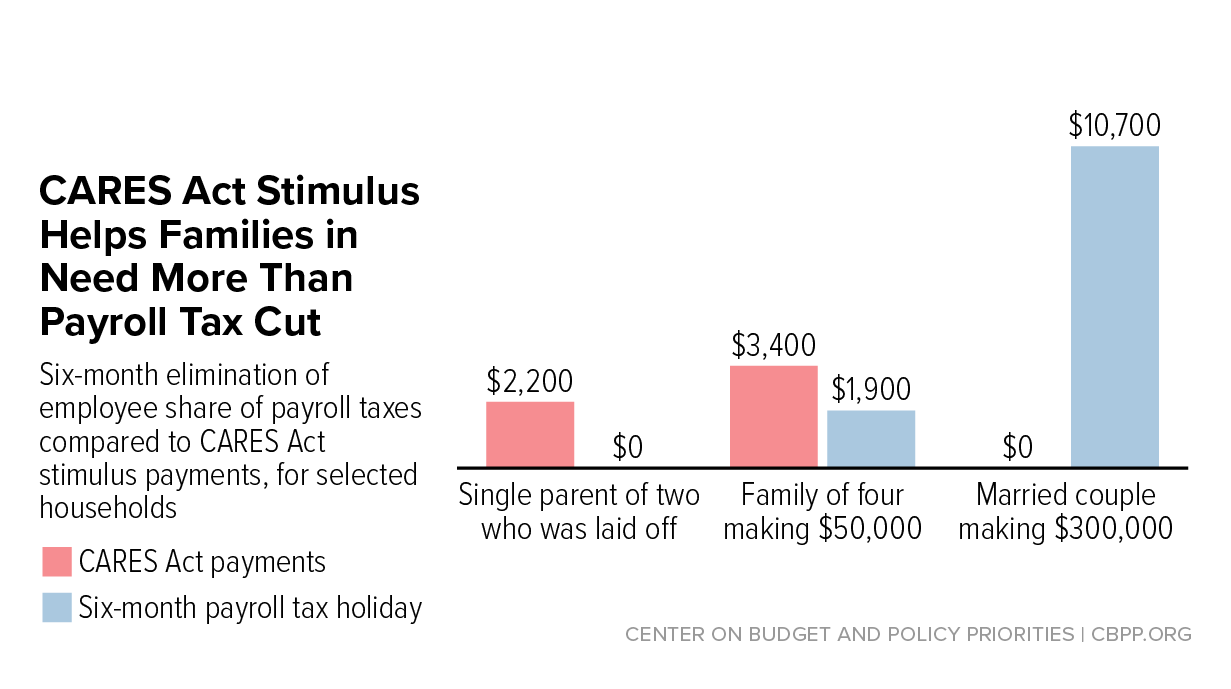

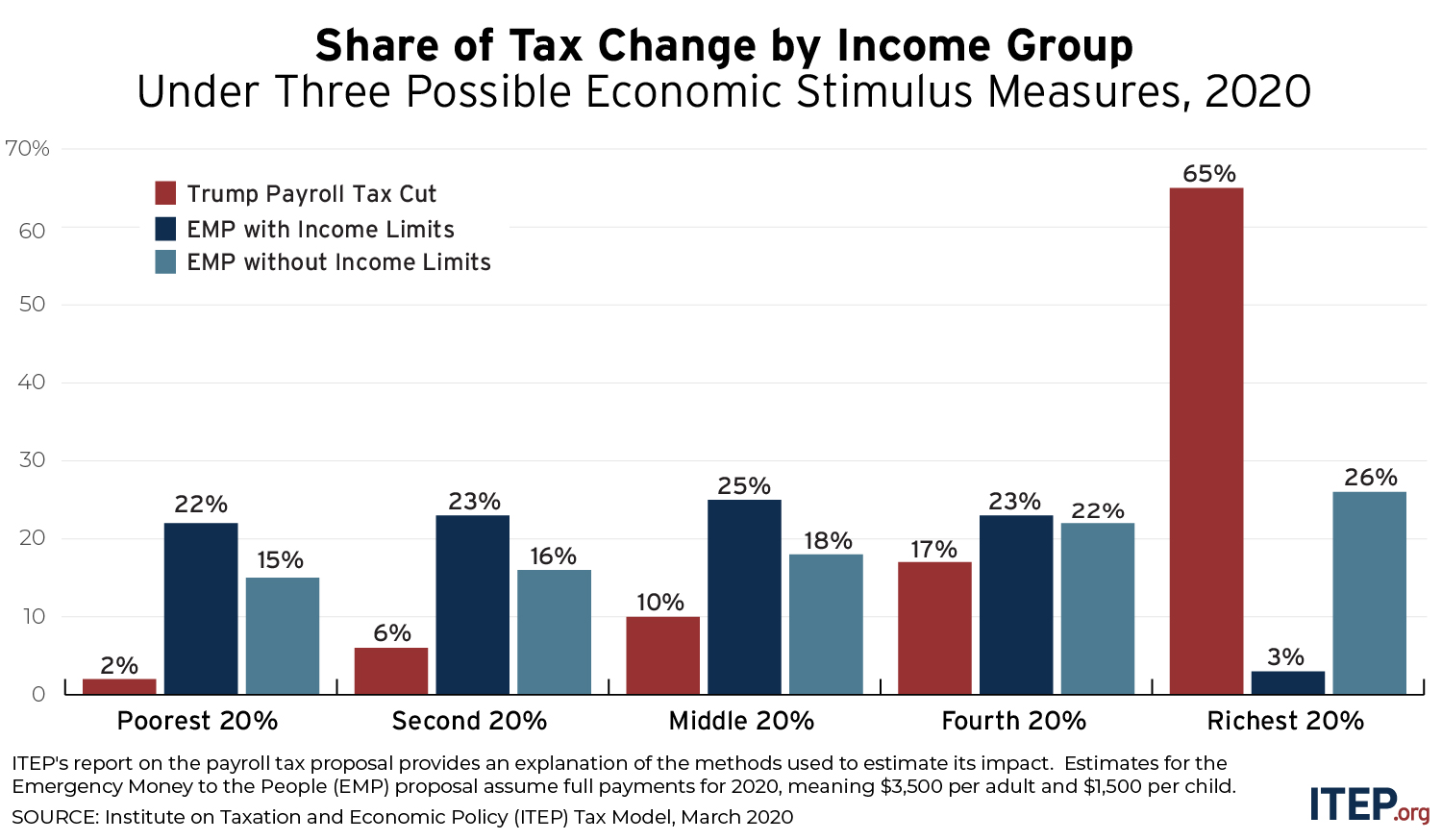

The tax is based on wages salaries and tips paid to employees. Payroll taxes are taxes imposed on employers or employees. The trump administration has pushed for payroll tax cuts as part of an economic relief package in response to the coronavirus pandemic.

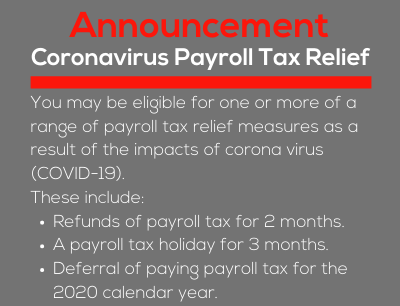

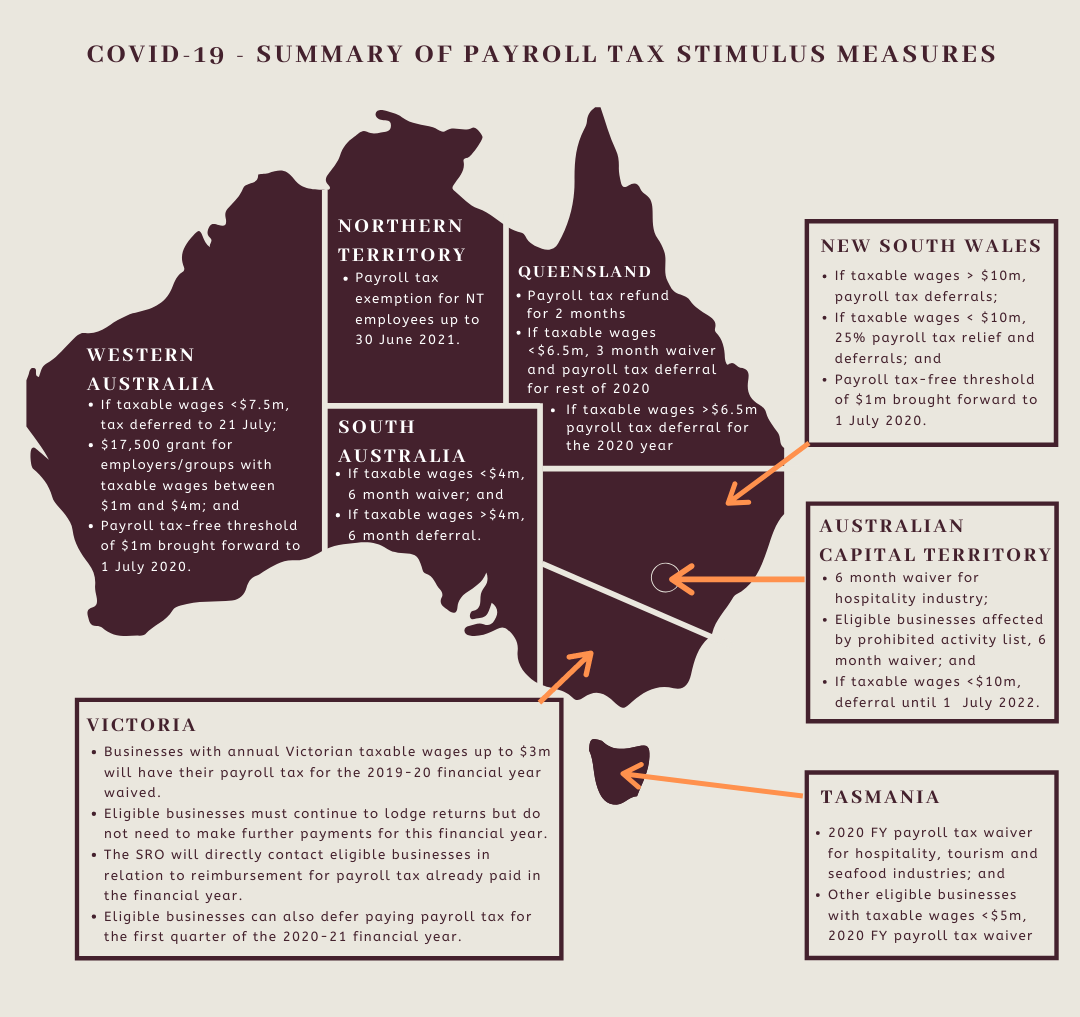

Applications for the payroll tax holiday for employers or part of a group of employers who pay 6 5 million or less in australian taxable wages closed on 31 may 2020. Payroll tax cuts could put more money in the pockets of. Companies get to defer payroll tax payments under coronavirus relief bill.

Whether these taxes went unpaid due to an error inability to pay because of financial troubles or because the business closed down you still need to pay what you owe to the irs. 2 quantify tax relief. That includes potential payroll tax cuts.

Contributions for salaries between the minimum wage and 1 6 times the minimum wage are eligible to relief known as fillon relief of up to 28 percentage points of employer contributions effectively halving employer non wage costs. This holiday relief does not have to be repaid. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers.

Employers should quantify the amount of eligible tax credits including management of eligible wage computations each pay period.

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)