What Is Payroll Tax Cut

Experts say such a move would not necessarily be a magic.

What is payroll tax cut. Assuming it s a 100 cut then someone making 15 per hour and. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. A payroll tax cut would mostly help people who are working and even more so the largest successful companies that have done fine before the pandemic and are still doing fine today.

A payroll tax cut is one idea president donald trump is considering in response to the negative effects of coronavirus on the u s. Payroll taxes generally fall into two categories. Traditionally democrats have favored payroll tax cuts because these cuts provide a direct tax cut that benefits workers over investors since payroll taxes are only paid on income from work and.

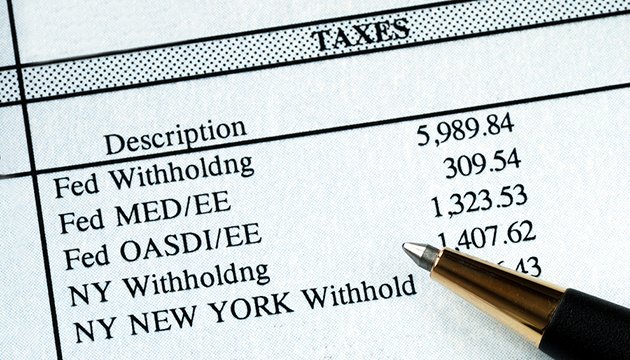

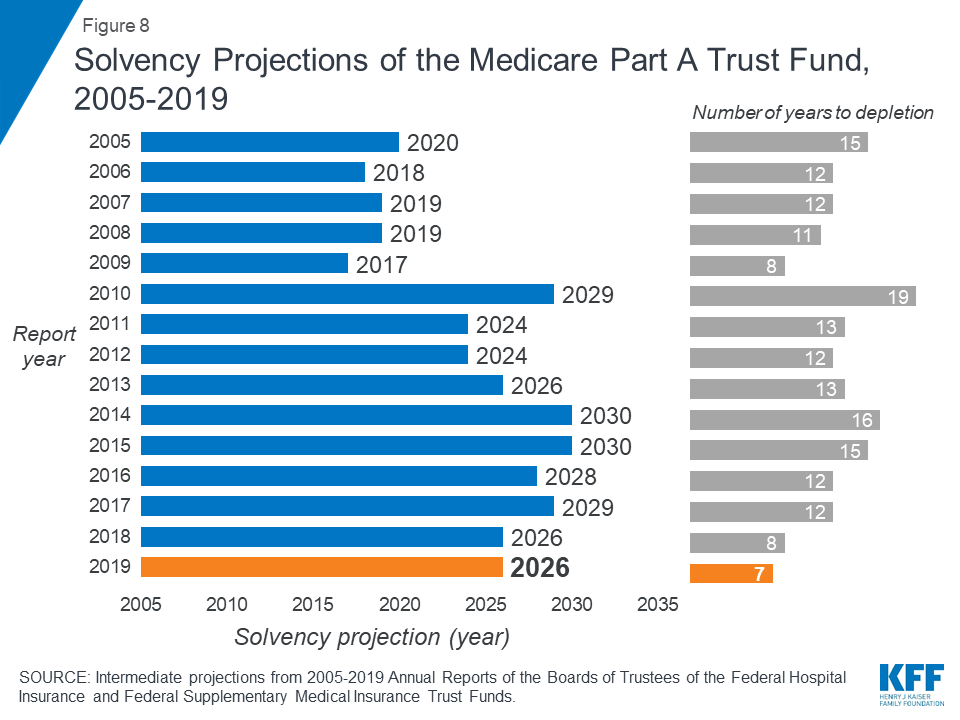

Payroll tax cuts could not only jeopardize the benefits for individuals who are retired or who are approaching retirement but could also point to bigger payroll tax hikes for younger generations. It s not clear if trump is pressing for a 100 payroll tax cut i e no tax is taken out of your paycheck or only a partial cut. Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their staff.

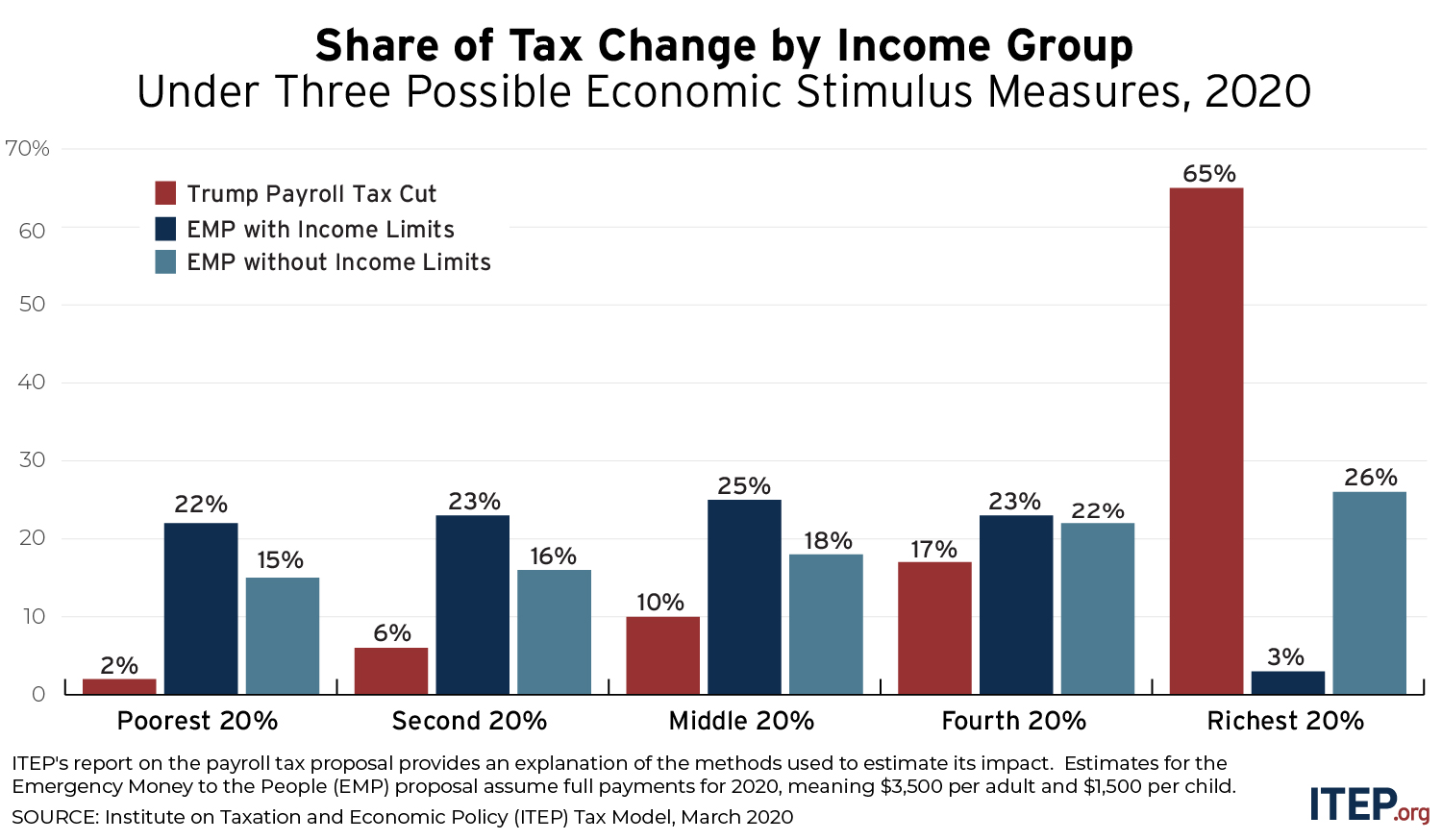

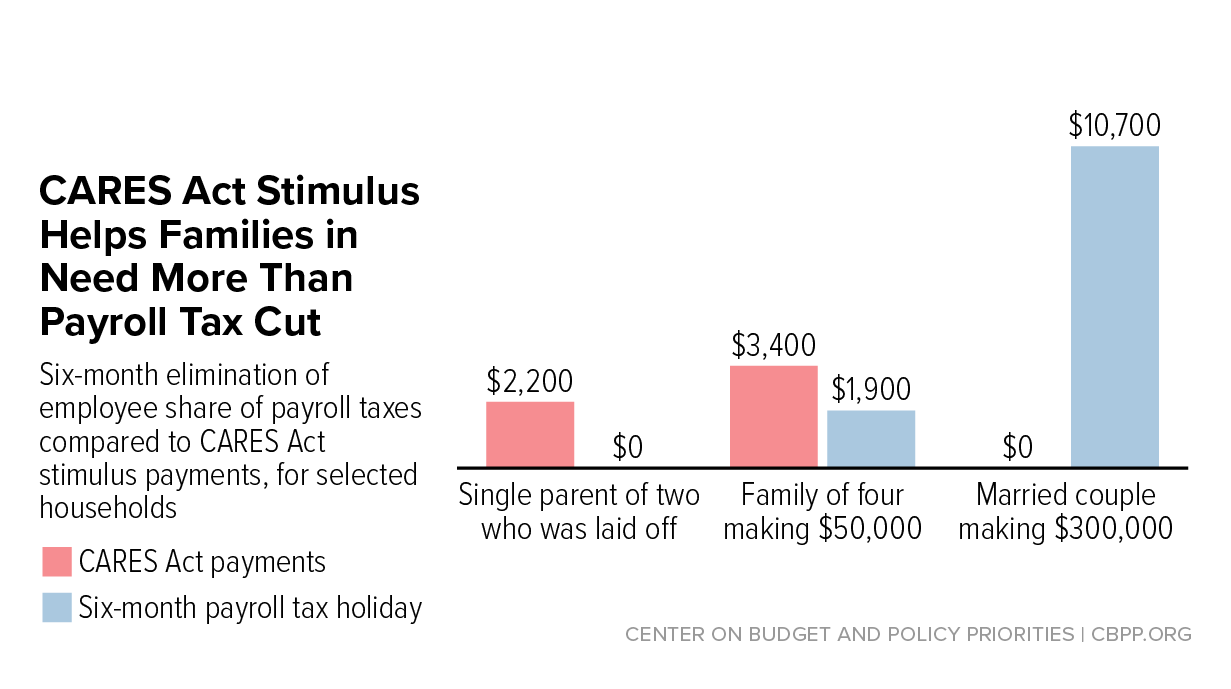

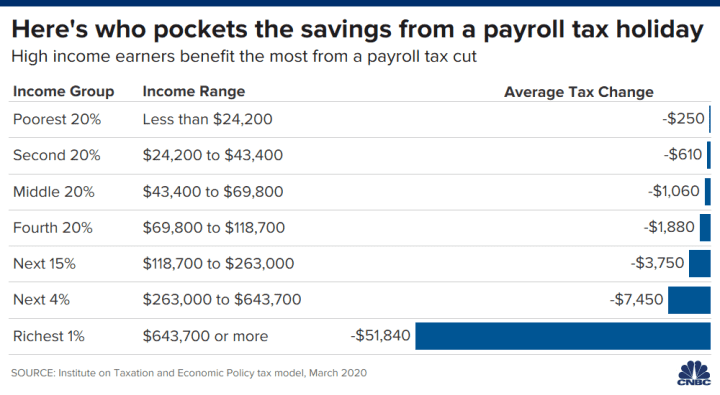

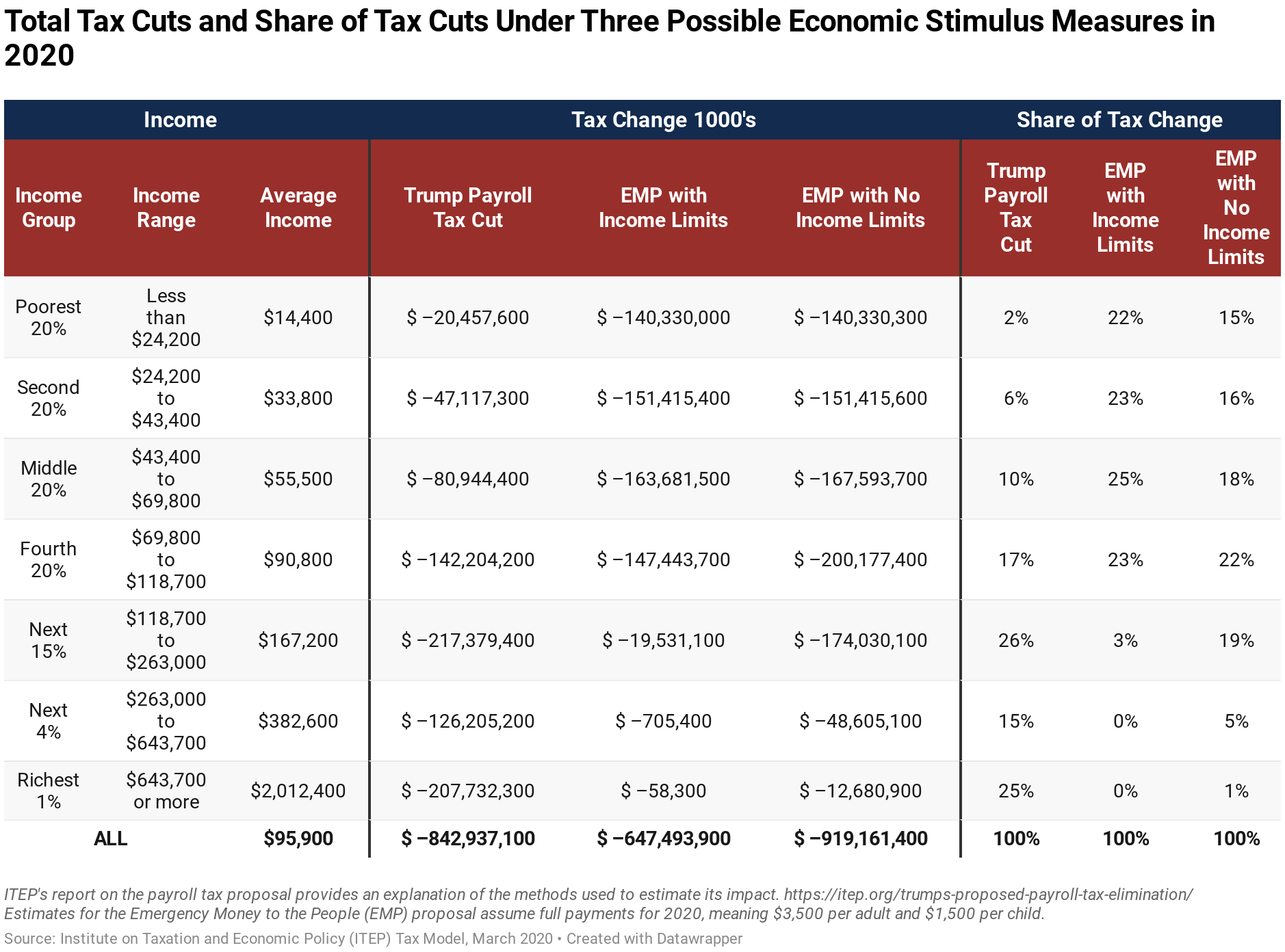

Payroll tax cuts waste money delivering the wealthy and powerful the largest cuts while providing nothing to those who need it most as this linked chart reveals.

/cloudfront-us-east-1.images.arcpublishing.com/tronc/6WLZLK7V3RGP7HPOETCBHRJUHY.jpg)