What Is Payroll Tax Cut Mean

Trump has not specified how large a payroll tax cut would be.

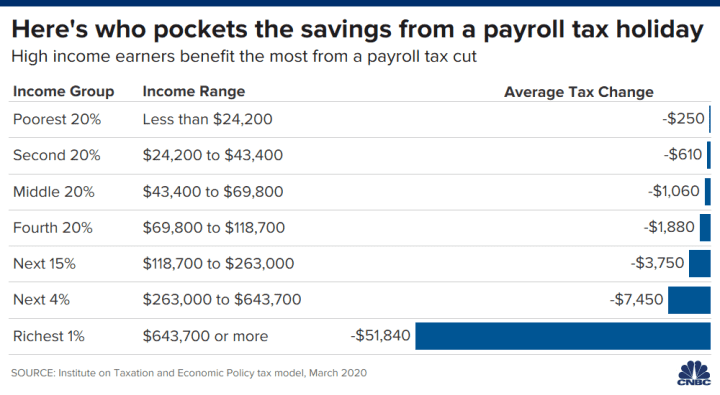

What is payroll tax cut mean. A similar payroll tax cut in 2019 could save top wage earners up to 2 658. When tax laws change your payroll taxes could change. That s because this economic slowdown is being driven by a fear of a disease rather than a.

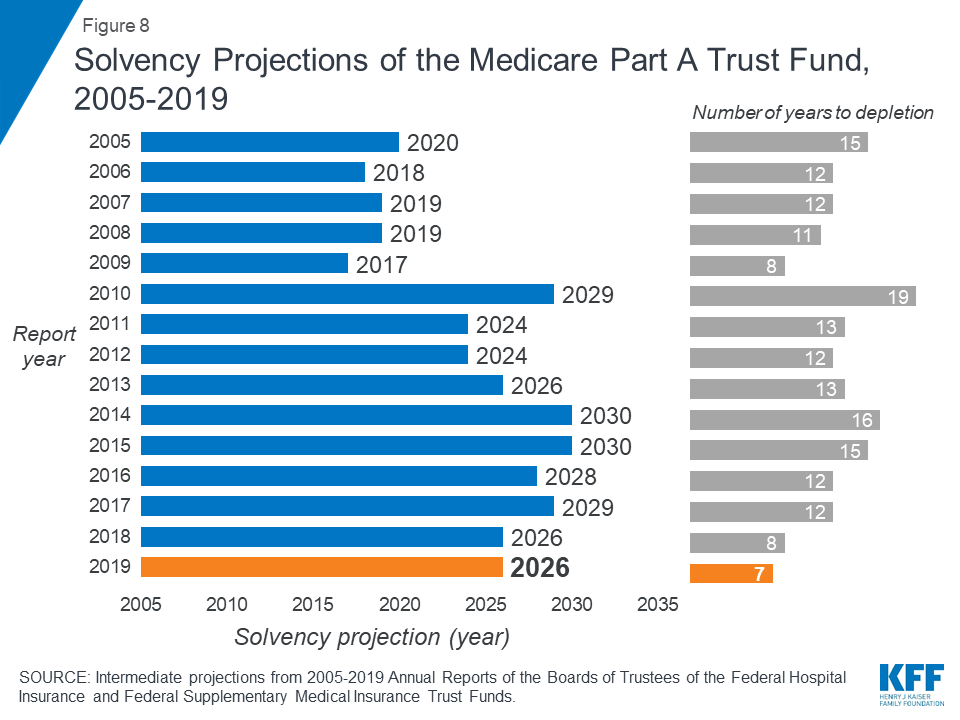

Trump hints at payroll tax cuts to mitigate coronavirus effects. If you get an income tax cut or an income tax increase or if your personal tax situation changes you may need your employer to withhold a. So if you re unemployed retired a stay at home parent or don t have a job for some other reason then the payroll tax.

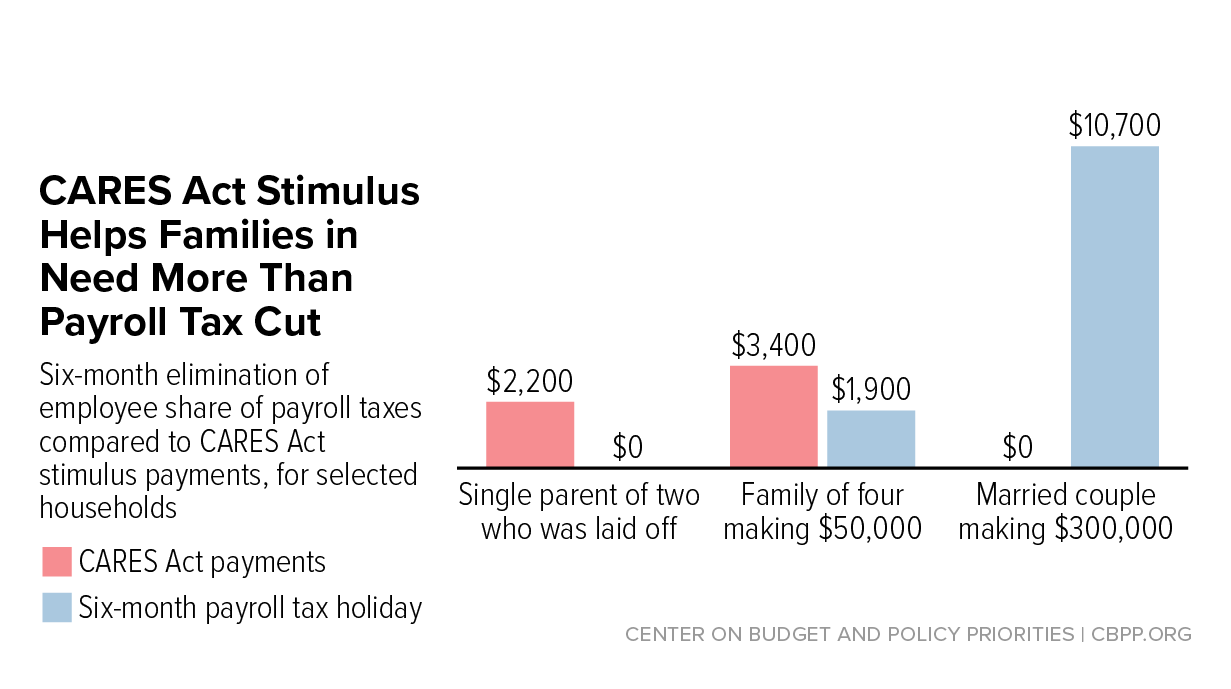

It s not clear if trump is pressing for a 100 payroll tax cut i e no tax is taken out of your paycheck or only a partial cut. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. A payroll tax cut might not have the desired effect of inspiring consumers to spend more gleckman said.

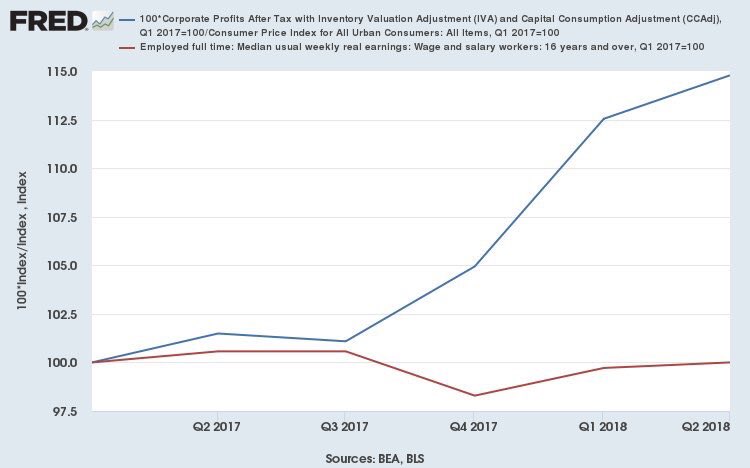

Assuming it s a 100 cut then someone making 15 per hour and. If trump were to pass a payroll tax cut he would not be the first president to do so. A payroll tax cut would mostly help people who are working and even more so the largest successful companies that have done fine before the pandemic and are still doing fine today.

Currently all employees and employers pay a 6 2 percent payroll tax on wages capped out at 137 700. Most full time wage and salary workers would save in the neighborhood of 908 or about a week s wages. Here s what that could mean for your pay.

/posttv-thumbnails-prod.s3.amazonaws.com/03-06-2020/t_90fb0700157d4ddb94e953abe4f8ca4c_name_2ddb7286_5fdf_11ea_ac50_18701e14e06d_scaled.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/tronc/6WLZLK7V3RGP7HPOETCBHRJUHY.jpg)

/PresidentTrump-3975bbb9a0e448b6a7a9b6db22281e41.jpg)